It’s been a busy year already for proposed Environmental, Social and Governance (ESG) reporting standards. The European Financial Reporting Advisory Group (EFRAG) has recently published a number of draft standards which would require tens of thousands of European companies not currently required to submit ESG disclosures to begin reporting on various aspects of sustainability.

These draft standards come hot on the heels of the Securities and Exchange Commission (SEC) in the United States issuing proposed rules that would require public US companies to publicly disclose specific ESG metrics, and the recently formed International Sustainability Standards Board (ISSB) released two draft exposure standards as part of its mission to bring more reliability and harmony to the assortment of competing ESG reporting frameworks out there. The draft EFRAG standards are particularly impactful because they would result in mandatory disclosures, and also demonstrate the general trend of ESG reporting becoming a regulatory requirement for an increasing number of companies.

In what follows, we’ll break down the draft standards and the background of the EFRAG, and provide some key takeaways about ESG.

Background of EFRAG Standards

EFRAG’s history began in 2001, when the European Commission requested the formation of a new agency to provide technical expertise and guidance on financial and accounting matters. In that capacity, they worked closely with the International Financial Reporting Standards (IFRS ®) Foundation, who themselves had recently formed in 2000. Major updates to EFRAG came in 2004 with changes to the governing structure and in 2009 with “EFRAG Plus” reforms to enable EFRAG to qualify for public funding by European Commission.

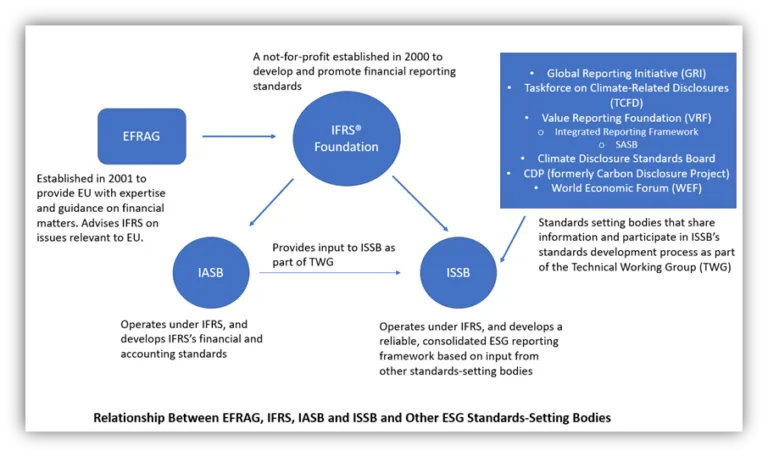

Through its advisory relationship with IFRS, EFRAG influences the International Accounting Standards Board (IASB), a group operating under the authority of IFRS which develops and approves its parent organization’s accounting and financial standards. For example, EFRAG is a member of the European delegation to the IASB Accounting Standards Advisory Forum (ASAF), and the CEO of EFRAG is a member of the IFRS Advisory Council.

As the financial and investor communities became aware of the importance of Environmental, Social and Governance (ESG) to better financial performance and avoidance of business risks, many reporting frameworks for key ESG metrics like GHG emissions started appearing. In response to stakeholder requests for more accurate and consolidated reporting frameworks, IFRS created a new subsidiary group called the International Sustainability Standards Board (ISSB), as we discussed in a recent blog post. EFRAG is of course also keenly aware of the intersection of ESG and financial performance, and through their continued relationship with IFRS will likely influence ISSB standards. But because other standards-setting organizations such as the Task Force for Climate-Related Disclosures (TCFD) and the World Economic Forum (WEF) participate in the working group helping to develop ISSB standards, there’s not likely to be perfect overlap between EFRAG and ISSB standards. In other words, the degree of consolidation we’ll get from ISSB standards remains to be seen, although the sync between EFRAG and IFRS will likely help.

Those are many connections to keep track of, so let’s look at an image to help. You can see the relationships between EFRAG, IFRS, IASB, and ISSB are mapped out below.

The biggest influence on EFRAG’s own ESG standard-setting priorities is the European Commission’s acceptance of a proposal for a Corporate Sustainability Reporting Directive (CSRD) in April 2021. The CSRD updates disclosures required by the Non-Financial Reporting Directive (NFRD), the current EU sustainability reporting framework, which sets disclosure for non-financial and diversity information by certain large companies. The CSRD proposal extends the scope to all large companies and all companies listed on regulated markets (except listed micro-enterprises), requires the audit (assurance) of reported information, introduces more detailed reporting requirements, and sets the stage for development of a specific sustainability reporting standards.

The organization with authority to develop the new standards envisioned by the CSRD proposal is EFRAG. In fact, EU Commissioner Mairead McGuinness formally requested that EFRAG develop those standards in a letter dated May 12, 2021.

The Draft EFRAG Standards

EFRAG’s new exposure draft standards, published on April 27, 2022, make good on their designated responsibility to develop new EU Sustainability Reporting Standards (ESRS). The drafts are now open to public consultation, to gather key stakeholder input.

The draft rules will significantly expand the number of European companies required to provide sustainability disclosures to over 50,000 from around 12,000 currently, introduce more detailed reporting requirements, and require audited assurance of the information reported.

Let’s take a look at the high-level details of each of the draft standards.

ESRS 1: General principles. This overarching draft standard describes the general principles applicable to preparation of sustainability statements, including criteria for preparing and presenting information, and disclosing policies, targets, actions and action plans. Notably, the draft states that EFRAG uses double materiality as the basis for required sustainability disclosures. That means that EFRAG frames the materiality, or relevance, of issues not only based on internal impacts to a company’s financial performance and shareholder value, but also in terms of external impacts on the environment and the public good.

ESRS 2: General strategy, governance, and materiality assessment disclosure requirements. This proposed draft sets out general requirements for disclosures across all areas of sustainability reporting. The draft groups disclosures into those of a general nature, those related to the strategy and business model, those related to governance in relation to sustainability, and those related to materiality assessment of sustainability impacts, risks and opportunities.

ESRS E1: Climate Change. This is an especially important standard, because disclosures related to climate risks are such an integral part of stakeholder and investor expectations. The draft standard sets out requirements that disclosures would need to indicate their impacts on climate change (both positive and negative), their mitigation efforts aligned with the Paris Agreement (or an updated international agreement on climate change) and the goal of limiting global warming to 1.5°C, their plans to adapt their business model to support those goals, and their existing resources and capacity to achieve those goals. The organization would also need to disclose the impacts of climate risks and opportunities on their financial performance. The draft standard also indicates specific metrics such as energy consumption and the “mix” of energy sources used, Scopes 1, 2, and 3 greenhouse gas (GHG) emissions, and total GHG emissions.

ESRS E2: Pollution. This draft standard would require affected organizations to disclose how their operations negatively or positively impact pollution of air (both indoor and outdoor), water (including groundwater) and soil, living organisms and food. The organization would also need to disclose the ways that their pollution activities create financial risks, the actions they’re taking to reduce impacts, and their changes to their business plan to accomplish those goals.

ESRS E3: Water and marine resources. The draft standard would require organizations to disclose how their operations either positively or negatively impact water and marine resources, describing such activities as reduction of water withdrawals, water consumption, water use, and water discharges in water bodies and in the oceans. They’d also need to disclose the degree to which their operations contribute to the European Green Deal’s ambitions for fresh air, clean water, a healthy soil and biodiversity, as well as to ensuring the sustainability of the blue economy and fisheries sectors, the EU water framework directive, and other globally established environmental limits.

ESRS E4: Biodiversity and ecosystems. The proposed draft would require organizations to disclose both negative and positive impacts on biodiversity and ecosystems, and actions they’re taking to mitigate harmful effects. The organization would also need to disclose the extent to which their operations contribute to the European Green Deal’s ambitions for protecting the biodiversity and ecosystems, the EU Biodiversity Strategy for 2030, the SDGs 2 Zero Hunger, 6 Clean water and sanitation, 12 Responsible consumption, 14 Life below water and 15 Life on land, and the Post-2020 Global Biodiversity Framework.

ESRS E5: Resource use and circular economy. The proposed draft would require organizations to disclose how the undertaking affects resource use, including the depletion of non-renewable resources and the regeneration of renewable resources, either positively or negatively. Organizations would also need to disclose their plans (and capacity to execute the plans) to adapt its business model and operations in line with circular economy principles including the elimination of waste.

ESRS S1: Own workforce. The proposed standard would require companies to disclose the approach they’re taking to identify and manage potential impacts related to working conditions, such as training and development, occupational health and safety, working hours, work-life balance, compensation and benefits. Other considerations include access to equal opportunities including equal pay and absence of discrimination on the basis of gender, race/ethnicity, nationality, religion, disability, age or sexual orientation, absence of forced labor or child labor practices, and protection of collective bargaining rights.

ESRS S2: Workers in the Value chain. This proposed standard would establish similar requirements related to planning how to establish and maintain fair and safe working conditions and equitable work environments, except as related to workers in the upstream or downstream value chain rather than the company’s own workers, because those are addressed in Standard ESRS S1 mentioned above. The draft states that the definition of “value chain workers” includes all non-employee workers whose work and/or workplace is controlled by the company’s operations, including individual contractors, third-party organization workers and self-employed persons.

ESRS S3: Affected communities. The proposed standard would require the organization to disclose how the organization positively or negatively affects its local communities through its operations and its upstream and downstream value chain (including its products and services, its business relationships and its supply chain). Some of the considerations an organization would need to address in its plans include impacts on communities’ economic, social and cultural rights (e.g. adequate housing, adequate food, water and sanitation), impacts on communities’ civil and political rights (e.g. freedom of expression, freedom of assembly), and impacts on particular rights of Indigenous communities (e.g. free, prior and informed consent, self-determination, and cultural rights).

ESRS S4: Consumers and end-users. The proposed standard would require disclosures on impacts for consumers/end-users related to issues such as freedom of expression, access to information, personal safety of consumers/end-users (especially including more vulnerable users such as children), and non-discrimination and fair access to products and services.

ESRS G1: Governance, risk management and external control. This standard establishes requirements for information companies would need to disclose abut governance factors, including the role of the company’s administrative, management and supervisory bodies (e.g., with regard to sustainability matters) and their composition, as well as a description of the company’s diversity, equity and inclusion (DEI) policy and how it’s implemented.

ESRS G2: Business conduct. This proposed standard would establish disclosure requirements for an organization’s plans related to business conduct. The draft standard indicates this disclosed information should cover a “wide range of behaviors that support transparent and sustainable business practices to the benefit of all stakeholders,” including business conduct culture, policies/actions to avoid unethical practices such as corruption and bribery, and transparency about anti-competitive behavior and political engagement or lobbying.

EFRAG will be accepting comments on its proposed standards until August 8, 2022. The cover note for the drafts provides more detail about the objectives and logistics of the public consultation, as well as background on CSRD’s requirements for developing draft ESRS.

Even though the draft standards cover a wide range of ESG topics, EFRAG repeatedly refers to them as “the first set of standards.” Time will tell how many additional standards come, and their areas of focus.

Key Takeaways on EFRAG’s Proposed Rules

There’s a lot of information to unpack from EFRAG’s proposed ESG disclosure standards. Here are some of the major takeaways:

ESG continues to be a central focus. We’re seeing more attention from both investors and regulatory agencies regarding ESG performance. There’s every indication that industry is collectively “saddling in” for using ESG as an important lens for assessing business strategy and impact for the long haul. And any businesses looking to achieve and maintain ESG maturity are going to need to follow the evolving reporting frameworks for ESG metrics. They’ll also need to have a broad view of materiality. EFRAG’s double materiality focus involves not just “bottom line” issues like impacts of ESG aspects on financial performance and shareholder value, but also broader issues involving the ways the company’s activities impact communities and the environment.

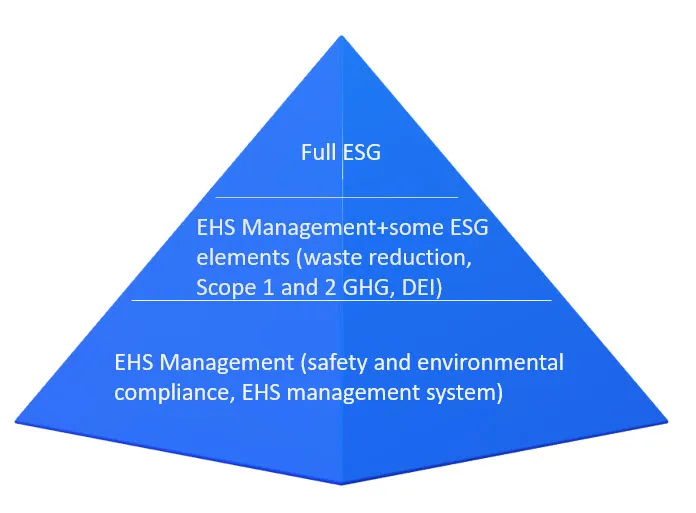

ESG depends on EHS. We can see this especially in EFRAG’s Pollution draft, because much of the information companies would be required to disclose includes knowledge of discharges to water and air and their potential impacts. Environmental Compliance software can be a big help here, by giving you visibility and quantifiable information about the nature of your air emissions and water discharges, and how concentrations of specific contaminants compare to established limitations. If you use environmental compliance software as part of an ESG solution that also includes tracking of GHGs, you’ll be able to maintain all levels of the ESG pyramid, as shown below.

You’ll need better visibility of energy usage and GHG emissions. The draft Climate standard would require businesses to track their energy consumption, their mix of energy sources (e.g., electricity, natural gas, propane, etc.) and all three scopes of GHG emissions. businesses hoping to establish and maintain ESG maturity need to start tracking those metrics now. Of course, the challenge is that many companies don’t have efficient processes for capturing and tracking data on all three scopes of GHG emissions, particularly Scope 3 sources like waste treatment facilities not under the organization’s direct control. Modern Climate software can help these organizations track all of their GHG emissions across all three scopes in a single platform, with simplified calculation and reporting capabilities. Software with utility integration capabilities can even capture your energy consumption data directly from your provider and instantly convert it to the units you need – eliminating the need to hunt down your data and perform manual calculations.

ESG is more than GHG reporting. While it’s understandable that companies pursuing ESG maturity have been focusing on GHGs, since they’re a common component of all major ESG reporting frameworks, there’s a lot more to getting ESG right. And we can expect that as ESG continues gaining momentum, stakeholders will increasingly demand more accountability in other areas, like waste minimization, and energy management. Organizations thinking about improving their performance across the whole spectrum of ESG will have an easier time keeping up with stakeholder expectations and evolving reporting frameworks.

Let VelocityEHS Help!

You’ll need powerful and flexible tools to keep up with the evolving ESG reporting landscape. Our ESG Software, part of our VelocityEHS Accelerate® Platform, will give you the support you need.

Our Environmental Compliance software simplifies the process of collecting key air emissions, water discharge and waste data, calculating concentrations of specific contaminants and enabling fast and easy reporting. And our VelocityEHS Climate Solution helps you improve your energy management and your tracking of GHG emissions. Powerful utility data integration capabilities ensure you’ll be able to capture all your energy data, easily convert it to the units you need, and identify trends in energy usage. We also provide a single platform for tracking all three scopes of GHG emissions, with reporting capabilities aligned with major ESG disclosure frameworks.

ESG is here to stay, so get the tools you need in place today to achieve and maintain ESG maturity. Request a demo or contact us today to learn more about how we can support your continuing ESG journey.