By Phil Molé, MPH

If you’ve been reading the news lately, you’ve probably heard about the passage of the Inflation Reduction Act, intended to address the rising costs of living for Americans. But you may not have heard that the Inflation Reduction Act allocates a significant amount of funds to the EPA to establish a Greenhouse Gas Reduction Fund (the Fund) to finance climate and clean energy projects, including projects intended to benefit historically marginalized and low-income communities. The EPA recently held a virtual public information session to solicit feedback on the administration of the Fund and eligibility for projects and recipients. The EPA’s plans for the Fund, and the level of stakeholder interest in the information session, show the continuing importance of Environmental, Social, and Governance (ESG) as a management approach. All this information is important for anyone interested in building or sustaining ESG maturity to understand.

Here’s a breakdown of the Fund, some main themes from the information session, and a few takeaways about the importance and future of ESG.

Background of the Greenhouse Gas Reduction Fund

The Inflation Reduction Act, signed into law by President Biden in August 2022, added new section 134 to the Clean Air Act, 42 U.S.C. § 7434, to establish the Greenhouse Gas Reduction Fund. EPA plans for the program to provide competitive funding to enable zero-emission technologies, as well as funds for financial and technical assistance for projects that reduce or avoid greenhouse gas (GHG) emissions and other forms of air pollution. EPA also intends, in keeping with its publicized commitment to “environmental justice,” that a significant percentage of funded projects are in low-income and disadvantaged communities.

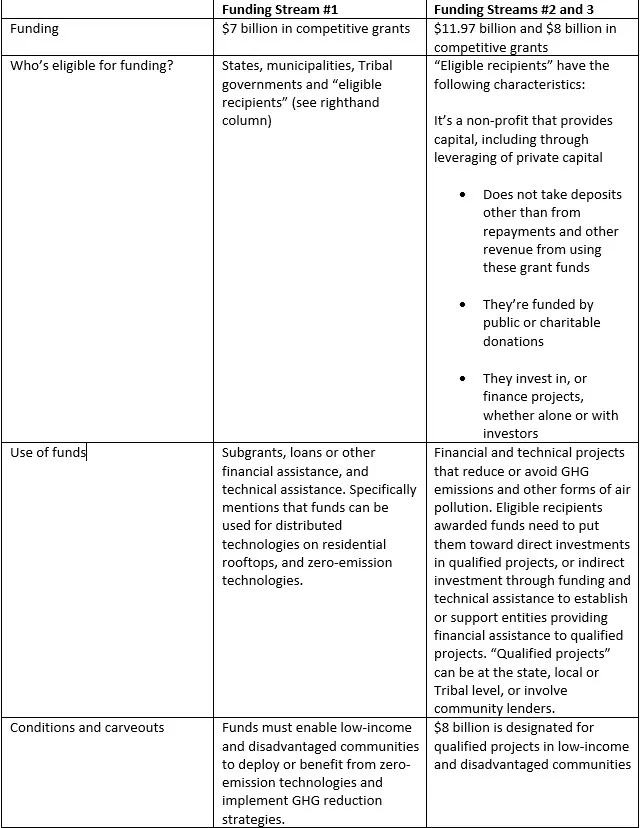

Funds are available to the EPA to award grants until September 30, 2024. The table below breaks down the three revenue streams the EPA is proposing to include in the Fund, who’s eligible and conditions of eligibility, and planned use of money.

The EPA states:

“This first-of-its-kind program will provide competitive grants to mobilize financing and leverage private capital for clean energy and climate projects that reduce greenhouse gas emissions – with an emphasis on projects that benefit low-income and disadvantaged communities – and further the Biden-Harris Administration’s commitment to environmental justice.”

The EPA has issued a Request for Information (RFI) to solicit public feedback on various aspects of the program’s design and implementation, including its focus on low-income and disadvantaged communities, eligibility criteria for projects and recipients, and oversight and reporting, or to provide general comments. Anyone interested in providing feedback to the EPA can submit comments in writing to the docket until December 5, 2022.

The EPA’s Focus on Environmental Justice

The EPA quote we included above referenced the aim of “environmental justice.” Let’s talk about that term for a moment.

The EPA began focusing on “environmental justice” in 2021, explaining the concept as being “fair treatment and meaningful involvement of all people regardless of race, color, national origin, or income, with respect to the development, implementation, and enforcement of environmental laws, regulations, and policies.” How will the Agency measure the achievement of that objective? According to the EPA, it will be through protection of all people in the US from environmental and health hazards, and improving access to members of all communities, including those traditionally not at the table, to opportunities to participate in the Agency’s decision-making processes. The EPA has also produced a fact sheet on environmental justice, as shown in the image.

Looking at this with some real-world context might help you get your head around this initiative. Think for a moment about the neighborhoods that tend to be closest to heavily industrial areas, waste treatment, storage, and disposal facilities (TSDFs), and shipping ports. These are low-income communities, sometimes due to the legacy of racially discriminatory practices in housing lending and urban planning. These communities bear the brunt of air and water pollution and may live in substandard housing with poor energy efficiency, which results in higher utility bills that compound their financial difficulties. And of course, the people living in these communities have historically been excluded when regulators were making important decisions that would impact their quality of life and economic opportunities.

This is the reality that the EPA is now trying to change, to the degree that it can, and it’s putting funding allocated via the Inflation Reduction Act to that purpose. In addition to providing financial resources toward the Fund, the Inflation Reduction Act supports other EPA environmental justice initiatives. These initiatives include a climate justice block grant for community-led air pollution prevention and climate protection projects, grants, and technical assistance to help schools address environmental issues and improve safety, funding zero-emission port equipment and technology, reducing emissions from trucks and heavy-duty vehicles, and improving the Agency’s enforcement technology. They will also help the EPA restore the long-expired Superfund petroleum tax. This tax on crude oil received at US refineries and petroleum products entering was originally part of Superfund program, established under the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) to clean up some of the country’s most contaminated sites, and was a vehicle to replenish financing of cleanup efforts until the tax expired over 25 years ago. The EPA expects the restored and inflation-adjusted tax to raise $11.7 billion in revenue until its scheduled expiration on December 31, 2032 and should make a positive impact on underserved communities by funding cleanup of legacy contaminated sites in their areas.

You now have the context to understand how exactly the EPA intends to use the Fund to advance environmental justice. The Greenhouse Gas Reduction Fund will finance projects that will reduce air emissions in underserved communities, provide better access to energy efficient buildings that will lower utility costs for community residents, and support community development initiatives.

Summary of EPA’s November 1 Public Meeting

The EPA held a public information session about the Fund on November 1, 2022, from 6 PM to 8 PM CT. It should be noted that the EPA held a second session on the evening of November 2 that we did not attend, so the summary below is based only on observations of the November 1 session.

The meeting began with several EPA representatives, including Taylor Gillespie and Dan Utech, summarizing details about the Fund, such as the eligibility criteria discussed above. They then turned the virtual floor over to participants, who each had a maximum of 3 minutes to speak and provide feedback. Participants in the call included representatives of community development organizations, financial lenders, representatives of state governments, policy think tanks, and private institutions who often participate in development projects. The exact attendance for the event wasn’t provided, although an EPA representative did state that “hundreds” of were in attendance.

Some key themes of stakeholder feedback were:

Focus on Economic and Racial Justice: Multiple stakeholders stressed the importance of ensuring that the EPA funds projects and recipients with the goal of environmental justice in mind. Several stakeholders made the case for including racial justice as a lens in addition to general economic justice, because of the generational impact of racially discriminatory practices such as redlining, in which financial institutions denied mortgage loans to Black Americans, and realtors refused to sell houses to them, based on assumptions about race and poverty then codified in official US housing policies. The broad consensus among stakeholders was that the EPA needed to fund projects based on prioritizing assistance to the populations who most often lack access to clean living environments and modern climate technology.

Eligibility and Selection of Recipients: Stakeholders had a range of opinions on the issue of which kinds of recipients the EPA should focus on. The different perspectives seem to stem from stakeholder perceptions about which kinds of recipients would be best situated to use the funds effectively and in accordance with the EPA’s stated aims, including the aim of environmental justice. Some stakeholders preferred that local credit unions receive and determine how to distribute funds. Other stakeholders suggested that community development financial institutions (CDFIs) or networks of community development organizations should distribute funds because they’re already involved in projects within many of the communities that would most need the support.

Another stakeholder specifically made a case for environmental creditors as ideal recipients. An “environmental creditor” is an entity who is financially affected by environmental contamination they did not cause, such as an owner of property adjacent to contaminated property that is owned or operated by a bankrupt potentially responsible party (PRP) as identified under CERCLA, or a landlord of a property that has a bankrupt PRP as its tenant. The stakeholder argued that such a creditor would have a clear incentive to use the EPA funds for site cleanup effectively and would therefore make an ideal recipient of those funds. It will be interesting to see how the EPA uses and reconciles the different perspectives on this issue as they move forward with establishing the Fund.

Eligibility and Funding of Projects: Many stakeholders offered perspectives on the kinds of projects the EPA should target for funding. Some participants in the call pointed out that part of the financial difficulty faced by residents of economically poor neighborhoods is that they live in older, less energy-efficient buildings, which results in higher energy bills that compound their challenges. Commenters stated that the EPA should prioritize projects to bring buildings up to modern energy efficiency standards, which would significantly reduce energy costs for residents.

One stakeholder specifically mentioned the benefits of solar energy installations to address energy poverty for homeowners and low-income renters. Another stakeholder provided the general consideration that projects should prioritize upgrading existing buildings rather than constructing brand-new energy-efficient buildings, since building construction is a very GHG emission-intensive process. Finally, one commenter suggested that for GHG reduction projects, the EPA should consider using some of the funding to create an incentivization program on a “per ton basis” of GHGs emissions reduced.

Data: Stakeholders brought up the issue of data usage and integrity in a couple of contexts. For example, they pointed out the necessity of good data to be able to vet the effectiveness of proposed technology for projects at reducing energy consumption or emissions, as well as for verifying that implemented projects are working as planned. Note that if the EPA takes up stakeholder recommendations to implement an incentivization program for GHG reduction, accurate metrics will need to be a crucial part of that.

Timeline of RFI: As we previously mentioned, the EPA is keeping the public comment period for the RFI open until December 5, 2022. At least one stakeholder during the call suggested that the current timeline for comments was not long enough and asked the EPA to consider extending the deadline. As of the time of this writing, the EPA’s webpage still indicates the original December 5, 2022 deadline.

Introducing ESG QuickTakes: A Sustainability E-Newsletter!

Master ESG with our NEW quarterly publication. Get expert insights on regulations, energy management, and sustainability delivered straight to your inbox.

Key Takeaways on the EPA’s New Greenhouse Gas Reduction Fund

There’s much we still don’t know about the Fund and how the Agency plans to administer it, especially considering the various feedback they received during the November 1 meeting. Still, here are some high-level takeaways.

ESG is Here to Stay

We’ve seen some headwinds for ESG in 2022, as covered in a recent blog post, but the evidence still points toward ESG settling in for the long haul. Data shows a clear relationship between ESG maturity and return on capital and demonstrates that companies with more successful ESG programs also tend to avoid volatility by avoiding major accidents or episodes of business mismanagement and drops in share price or company valuation because of those events.

The Fund adds more supporting evidence for the durability of ESG. It shows us that a major US federal regulatory agency is using ESG as the basis for its initiatives. EPA’s program sits alongside and complements state “green banks” to fund clean energy products, and global initiatives such as the European Union’s use of the Green Taxonomy to grow the economy sustainably, in part through using fixed-asset investments in green bonds to fund climate and energy projects. Furthermore, the significant attendance of the event shows that many stakeholders support the EPA’s focus on ESG, and their feedback showed great enthusiasm for the potential benefits of the Fund.

Furthermore, the importance that both the EPA and its stakeholders are placing on environmental justice has something to teach us about the growing importance of social sustainability to ESG. Social sustainability is about building healthy and sustainable places, both inside and outside of any given company. The EPA intends to use the Fund to enhance the lives of historically underserved communities, while also promoting general environmental health.

GHG Tracking is Crucial to ESG

Our discussion of the Fund’s eligibility criteria for recipients and projects showed that the EPA is focusing on funding initiatives that reduce GHG emissions. As we’ve discussed in a past blog post, tracking and disclosure of GHGs are central to ESG management – a fact apparent by their inclusion in every major ESG disclosure framework. The GHG Protocol has produced standards that define the three different scopes of GHGs, including Scope 3 GHGs, which are indirect emission sources not under the direct control of the company. GHG Protocol has established industry-accepted accounting practices, and their Value Chain Standard details 15 categories of Scope 3 GHGs.

Companies have historically struggled to identify and accurately track their Scope 3 GHGs. Modern ESG software can help by giving you a single platform for tracking and reporting all three scopes.

You’re Only as Good as Your Metrics

As discussed earlier, good metrics will be crucial for securing funding through the EPA’s program, as well as for measuring the success of programs implemented. In fact, good metrics are one of the key ingredients of any successful ESG program or initiative. They demonstrate to internal and external stakeholders that you’ve accomplished the specific objectives and targets you set out to accomplish.

Many of the projects funded through the EPA’s program will likely involve reduction of utility energy usage and associated emissions. Not surprisingly, these kinds of projects are common undertakings for businesses as well, especially those beginning their ESG journey.

The challenge in many of these projects starts with getting good data, and with being able to easily perform the calculations needed, such as unit conversions or application of correct emission factors. Modern ESG software makes this easier, through utility integration that directly captures your energy usage data at the source, reducing potential for errors from manual entry, and automatically applying the correct emission factors and converting metrics to the units you need.

For a deep dive into ESG topics, attend the upcoming VelocityEHS Virtual ESG Conference. Join us on November 15, 2022 for five sessions that will discuss topics such as the proposed mandatory SEC climate disclosure requirements, how to choose the right carbon management software for your organization, tracking social sustainability goals, Green Chemistry, and managing climate risks. We’ll give you the information you need to successfully build and maintain ESG maturity!

REGISTER FOR OUR VIRTUAL ESG CONFERENCE!

Let VelocityEHS Help!

EPA’s establishment of the Greenhouse Gas Reporting Fund is one more reminder that the world of ESG is constantly evolving. Luckily, our ESG Software, part of the VelocityEHS Accelerate ® Platform, provides exactly the support you need. You can easily track all three scopes of your GHG emissions, with reporting capabilities aligned with major ESG disclosure frameworks. Built-in Materiality Assessment capabilities within the software also help you easily generate surveys and materiality matrices you can share with stakeholders, so you can be sure you’re identifying and focusing on easier –to-miss important ESG issues such as categories of your Scope 3 GHGs.

ESG is here to stay, so get the tools you need in place today to achieve, pursue and maintain ESG maturity. Request a demo or contact us today to learn more about how we can support your continuing ESG journey.