By Phil Molé, MPH

France has become the first EU member to incorporate the Corporate Sustainability Reporting Directive (CSRD) into its national law. The CSRD, and along with it, the first European Sustainability Reporting Standards (ESRSs), went into effect on January 1, 2024, and the process of determining how to comply with these regulatory obligations just got even more difficult for affected EU and EU-listed companies now that France has adopted the CSRD.

In what follows, we’ll break down the details of France’s transposition of the CSRD and provide takeaways about how to prepare, as well as what this could soon mean for your business when it comes to ESG.

What Is the Background of the CSRD?

The European Commission accepted a proposal for a CSRD to revise the Non-Financial Reporting Directive (NFRD). At that time, the NFRD EU sustainability reporting framework established disclosure requirements for non-financial and diversity information by certain large companies. European Parliament and EU Council adopted the CSRD in December 2022, setting the stage for the development of specific sustainability reporting standards. A crucial part of that adoption is that all EU member states must formally adopt the CSRD and integrate the CSRD into their own national laws within 18 months, a time interval which will end in July 2024.

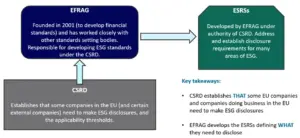

European Financial Reporting Advisory Group (EFRAG) is an EU organization founded in 2001 (to develop financial standards) and has worked closely with other standards-setting bodies. In a letter dated May 12, 2021, EU Commissioner Mairead McGuinness formally requested that EFRAG develop ESG standards under the CSRD. EFRAG issued its first set of draft ESRSs in April 2022.

The ESRSs address many areas of ESG, including not only greenhouse gas (GHG) emissions and general disclosure requirements, but also aspects of social sustainability. Social sustainability describes efforts to create and support healthy places inside and outside company environments, including relationships with communities and workers outside of the company’s own workforce. For example, EFRAG included a standard that addresses the management of workers in the value chain, such as suppliers and contractors, who might bear some of the impacts of the company’s operations. It also included a standard on “affected communities” that prompts companies to assess how their business operations impact community equity in terms of access to clean air, clean water, and adequate housing. The standards also widen the lens of environmental sustainability, tasking companies with understanding and mitigating their impact on marine life and biodiversity.

The EU adopted the final ESRSs after consultation with EU member states in June 2023. The ESRS create mandatory reporting obligations for over 50,000 EU and EU-listed companies, most of which had not currently been making ESG disclosures.

The relationship between the CSRD, EFRAG, and the ESRSs is shown in the diagram below.

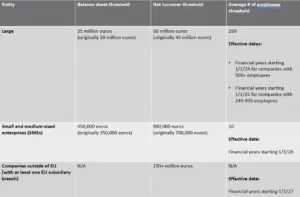

Because the CSRD went into effect on January 1, 2024, the ESRSs are now also in effect, starting with the biggest EU companies as defined by financial characteristics. The chart below shows the categories of companies covered by the CSRD, and their applicable compliance timelines:

What’s Changing Now That France Has Adopted the CSRD?

Acting under the authority of Article 12 of French Law No. 2023-1714, which contains provisions for aligning French law with EU law in the fields of the economy, health, labor, transport, and agriculture (2023 DDADUE Law), French Order No. 2023-11425 (the French Ordinance) transposed the CSRD into national law. With this Order, France has become the first EU country to officially codify CSRD requirements.

To better understand France’s implementation of the CSRD, you first need to understand the obligations of companies required to prepare and submit sustainability reports under the CSRD.

Once a company prepares its sustainability reports, they must then have the information contained in their sustainability report certified by an “auditor” specialized in sustainability issues. This auditor may be a statutory auditor or an accredited independent third-party body, such as an authorized accountant or lawyer.

Through the process of adopting the CSRD, many French companies that had not previously needed to prepare and submit sustainability reports via the existing Extra Financial Performance Declaration (EFPD) requirements of the French Commercial Code will now need to do, with their reports certified by an auditor.

French Order No. 2023-11425 states that an injunction, subject to a penalty, may be sought by any “interested party” before Court under interim proceedings to obtain the “production, communication, or transmission of documents or information relating to sustainability, or the appointment of an agent to carry out such communication,” (e.g., the required sustainability reports). It may be too early to know how this process of seeking an injunction will be interpreted and applied, but by its plain language, the wording in the Order suggests the possibility of giving standing to many different potential parties, including shareholders, employees, community members, and customers (among others) in forcing the production of the required reports.

France’s enforcement mechanism also stipulates criminal sanctions in several cases, as described below:

- Failing to appoint an auditor or independent third-party organization, with a fine of up to €30,000 and imprisonment up to two years for company director(s) and a fine up to €150,000 for the legal entity;

- Failing to convene the auditor or independent third-party organization, with a fine of up to €30,000 and imprisonment up to two years for the company director(s) and a fine up to €150,000 for the legal entity;

- Obstructing audits or controls by the auditor or independent third-party organization or their experts, with a fine of up to €75,000 and imprisonment up to five years for the company director(s) and a fine up to €375,000 for the legal entity; and

- Refusing the auditor or independent third-party organization or their experts on-site access to all documents required for the performance of their duties and, in particular, to all contracts, books, accounting documents, and minute books, with a fine up to €75,000 and imprisonment up to five years for the company director(s) and a fine up to €375,000 for the legal entity.

As these provisions show, French companies subject to disclosure requirements will need to provide the mandated sustainability information in a timely manner. Of course, they’ll also only be able to meet these requirements if they have good sustainability data to start with and streamlined ways of organizing their data into disclosure reports.

What Information Will French Companies Need to Report?

It’s important to note that in adopting the CSRD, France is also adopting the double materiality concept that the CSRD and ESRSs apply. In the world of ESG, “materiality” means relevance, and there are two primary ways of measuring it.

An ESG issue has financial materiality if it impacts a company’s business performance or overall value. Financial materiality metrics may include revenues, turnover/units of product sold, or stock prices. If an ESG issue affects the world outside the company, such the economy, the environment, or communities, it has impact materiality. It should be noted that these two categories aren’t mutually exclusive, and many stakeholders would argue that issues that primarily affect impact materiality, such as air or water pollution, will likely also have financial materiality, whether in the form of fines, exposure to lawsuits, or loss of reputation and customer confidence due to bad publicity. The CSRD and EFRAG’s ESRSs are based on double materiality, which means that disclosures under France’s adoption of the CSRD will be based on double materiality, as well.

Considering the wider lens of materiality being applied, companies subject to France’s disclosure regulation will need to report a variety of different aspects of their ESG performance, including:

- How resilient the company’s business model and strategy are, regarding the risks associated with sustainability issues;

- The opportunities that sustainability issues present for the company;

- The company’s plans, including actions taken or contemplated and related financial and investment plans, to ensure the compatibility of its business model and strategy with the transition to a sustainable economy; the limitation of global warming to 1,5°C in accordance with the Paris Agreement adopted under the United Nations Framework Convention on Climate Change, and the objective of climate neutrality by 2050; and, if applicable, the company’s exposure to coal-, oil-, and gas-related activities;

- How the company’s business model and strategy consider stakeholders’ interests and the impact of the company’s activity on sustainability issues;

- How the company’s strategy is implemented regarding sustainability issues;

- The company’s time-bound sustainability objectives and progress towards these objectives, including, when appropriate, absolute GHG emission reduction targets at least for 2030 and 2050;

- The role of management, administrative, or supervisory bodies with regard to sustainability issues, as well as the skills and expertise of the members of these bodies in this respect, or the opportunities available to acquire them;

- The company’s policies on sustainability issues;

- The existence of incentive schemes a company grants to members of its management, administrative, or supervisory bodies in relation to sustainability issues;

- The due diligence process implemented by the company regarding sustainability matters and the negative impacts identified in this context, and, where applicable, in line with EU legislation;

- The main potential or actual negative impacts connected with the company’s own operations and with its value chain, the measures taken to identify, monitor, prevent, eliminate, or mitigate these negative impacts, and the results obtained; and

- The main risks of sustainability issues to the company, including its main dependencies, and the way in which it manages these risks.

Companies subject to these reporting requirements must submit their sustainability data in a specific section of their management report, as provided by Article L. 232-6-3 of the French Commercial Code. This section must also include a description of the process companies must follow to gather the relevant information.

Which French Companies Must Prepare Sustainability Reports?

The chart below breaks down the different categories of French companies and their applicable reporting timelines:

| Company category | Reporting year | Year that first reports are due |

| Large companies already subject to the DPEF | FY 2024 | 2025 |

| Other large companies | FY 2025 | 2026 |

| SMEs listed on a European regulated market, excluding micro-undertakings | FY 2026 | 2027 |

| Foreign groups | FY 2028 | 2029 |

Will Other EU Countries Incorporate the CSRD into Law?

As mentioned previously, EU’s adoption of the CSRD in late 2022 came with a provision for EU member countries to formally transpose the CSRD into their national laws within 18 months. This means that all EU member countries need to nationalize CSRD into their laws by July 2024, so we can expect to see other EU member countries incorporate the CSRD into their own national laws over the coming months.

Also, now that France has provided a structured example of what national implementation looks like, it’s fair to expect that many other EU countries will adopt similar legal mechanisms for enforcement, including potential fines and criminal sentences.

What Does France’s Adoption of the CSRD Tell Us About the Importance of ESG?

France’s adoption of the CSRD, and the forthcoming adoption by other EU nations, remind us that ESG isn’t going away anytime soon. Companies are finding that regulators, value chain partners, investors and customers alike see ESG disclosures as an integral part of business.

The transposition of the CSRD into law by EU countries is part of a growing trend of mandatory ESG disclosures. For example, non-EU countries like New Zealand and Hong Kong have already adopted ESG disclosure regulations. In the US, the Securities and Exchange Commission (SEC) has published a proposed rule that would require all companies registered with SEC (i.e., publicly listed companies) to disclose various aspects of their management of climate-related risks and opportunities, including business strategies they’re using, details about whether they’re following a climate transition plan, and their GHG emissions.

Even if you don’t yet face regulatory obligations to prepare and submit ESG disclosures, your value chain partners might, and they will be looking to ensure that anyone they conduct business with has the data to demonstrate their ESG performance. Investors and banks are also increasingly requesting ESG data to assess financial risks, determine whether to lend to individual organizations, and at what interest rate.

The bottom line is that if you’re not already making disclosures, you probably will be making them someday soon. Get a plan in place and evaluate the ability of your systems to collect and disclose good ESG data now, because many of your competitors may already have started doing so. Get the tools you need to do ESG right and capitalize on ESG opportunities before they become liabilities.

Let VelocityEHS Help!

Our ESG Solution, part of the VelocityEHS Accelerate® Platform, makes it easy for businesses like yours to track your GHG emissions. Our Utility Data Sync capabilities interface directly with your utility provider, collecting your energy consumption data at the source and automatically applying the correct emissions factors and unit conversions to minimize potential for error. You’ll get powerful data assurance and data integrity reporting to demonstrate that you’re maintaining investor grade data and give your investors and stakeholders confidence in your disclosures.

Simplified GHG reporting is only one of the benefits of our ESG solution. You’ll also get comprehensive ESG materiality assessment tools to identify and prioritize your most important ESG issues, easily deploy materiality surveys to your stakeholders, analyze their responses, and communicate results through an easy-to-understand materiality matrix.

Ready to learn more? Contact us anytime to find out how our software helps you build an ESG program that works.