Tracking and reporting of greenhouse gas (GHG) emissions are central to doing environmental, social and governance (ESG) right. Internal and external stakeholders expect companies to demonstrate good GHG management practices, which is a major reason why both voluntary and mandatory ESG disclosure frameworks established GHG reporting responsibilities for companies. The GHG Protocol produces standards that can help businesses like yours learn industry-accepted GHG accounting practices that contribute to achieving ESG maturity.

It’s more important than ever for EHS and business managers to understand the relevancy of the GHG Protocol when it comes to better ESG management. In what follows, we’ll break down the purpose of GHG Protocol, discuss two of its most significant standards, and leave you with some key takeaways about the role of GHG accounting in ESG management.

The History and Purpose of the Greenhouse Gas Protocol

The history of the GHG Protocol reminds us that what we’re now calling Environmental, Social and Governance isn’t new.

The story begins in 1998, when the World Resources Institute (WRI) published a report called “Safe Climate, Sound Business.” This report identified the need for concerted actions to address climate change, including standardized measurement methods for GHG emissions.

The World Business Council for Sustainable Development (WBCSD) had been discussing similar initiatives and formed a partnership with WRI in the late 1990s to establish the GHG Protocol as an organization responsible for developing standardized GHG accounting methods. The GHG Protocol established a core group, consisting of representatives from environmental advocacy groups as well as industry, to guide the process of developing GHG accounting standards based on recognized best practices.

The GHG Protocol issued the first edition of its first standard, the Corporate Accounting and Reporting Standard, in 2001 and revised it in 2004. Over the years, the GHG Protocol has also published other standards related to various aspects of GHG accounting. All the standards issued by the GHG Protocol to date are listed below.

- GHG Protocol Corporate Accounting and Reporting Standard (2004): A standardized methodology for companies to quantify and report their corporate GHG emissions. Also referred to as the Corporate Standard.

- GHG Protocol Product Life Cycle Accounting and Reporting Standard (2011): A standardized methodology to quantify and report GHG emissions associated with individual products throughout their life cycle. Also referred to as the Product Standard.

- GHG Protocol for Project Accounting (2005): A guide for quantifying reductions from GHG-mitigation projects. Also referred to as the Project Protocol.

- GHG Protocol for the U.S. Public Sector (2010): A step-by-step approach to measuring and reporting emissions from public sector organizations, complementary to the Corporate Standard.

- GHG Protocol Guidelines for Quantifying GHG Reductions from Grid-Connected Electricity Projects (2007): A guide for quantifying reductions in emissions that either generate or reduce the consumption of electricity transmitted via power grids, to be used in conjunction with the Project Protocol.

- GHG Protocol Land Use, Land-Use Change, and Forestry Guidance for GHG Project Accounting (2006): A guide to quantify and report reductions from land use, land-use change, and forestry, to be used in conjunction with the Project Protocol.

- Measuring to Manage: A Guide to Designing GHG Accounting and Reporting Programs (2007): A guide for program developers on designing and implementing effective GHG programs based on accepted standards and methodologies.

The Corporate Accounting and Reporting Standard (Corporate Standard)

The GHG Protocol revised the Corporate Standard in 2004 to include more guidance, case studies, and an additional chapter on setting GHG targets. The Corporate Standard covers the accounting and reporting of the six greenhouse gases covered by the Kyoto Protocol—carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulfur hexafluoride (SF6).

The GHG Protocol designed the Corporate Standard to help companies prepare a GHG inventory that represents a true and fair account of their emissions, to improve transparency in GHG accounting, simplify and reduce the costs of compiling a GHG inventory, and provide information to help businesses build an effective strategy to manage and reduce GHG emissions and participate in both voluntary and mandatory GHG programs.

Companies structuring their management of GHGs according to the Corporate Standard would need to track the following sources, or scopes, of GHGs:

- Scope 1: Direct emissions from owned or controlled sources

- Scope 2: Indirect emissions from the generation of purchased energy consumed by the reporting company

- Scope 3: All other indirect emissions that occur in a company’s value chain

The Corporate Standard allows flexibility for companies in whether and how to account for scope 3 emissions. To expand upon the guidance for organizations tracking their Scope 3 emissions, GHG also developed the Corporate Value Chain Standard.

The Corporate Value Chain (Scope 3) Standard

The Scope 3 standard is a supplement to the GHG Protocol Corporate Standard, and users should reference that document when using it.

The Standard defines Scope 3 GHG emissions as “all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.”

Upstream emissions, according to the Standard, are defined as indirect GHG emissions related to purchased or acquired goods or services. Downstream sources are indirect GHG emissions related to sold goods and services.

The Standard categorizes Scope 3 emissions into fifteen distinct categories, classified as either “downstream” or “upstream” relative to the company, as shown in the table below.

| Upstream or Downstream | Scope 3 Category |

| Upstream | Purchased goods and services |

| Upstream | Capital goods |

| Upstream | Fuel and energy-related activities (not included in Scopes 1 or 2) |

| Upstream | Upstream transportation and distribution |

| Upstream | Waste generated in operations |

| Upstream | Business travel |

| Upstream | Employee commuting |

| Upstream | Upstream leased assets |

| Downstream | Downstream transportation and distribution |

| Downstream | Processing of sold products |

| Downstream | Use of sold products |

| Downstream | End-of-life treatment of sold products |

| Downstream | Downstream leased assets |

| Downstream | Franchises |

| Downstream | Investments |

As the above table shows, there are many different sources of Scope 3 GHG emissions upstream and downstream of a company’s operations. In fact, Scope 3 emissions often represent the largest source of emissions for companies and are associated with the most significant opportunities to influence GHG reductions and achieve GHG-related business objectives.

It’s also important to understand that while the GHG Protocol itself does not establish regulatory requirements to track Scope 3 GHGs, there are ESG frameworks that do. For instance, the proposed Securities and Exchange Commission (SEC) rule in the US would require publicly traded companies to track Scopes 1 and 2 GHGs, and Scope 3 GHGs if determined to be financially material – meaning that they could impact financial performance and decisions made by shareholders and investors.

This means that companies need to recognize if they are subject to mandatory ESG disclosure frameworks, because in that case, reporting all scopes of GHGs would no longer be optional. Arguably, even companies not subject to specific regulatory requirements to report their GHG metrics should strongly consider doing so, because they’re competing against companies actively managing and reporting their GHG emissions and given increasing stakeholder expectations for companies to do so, those organizations making GHG disclosures will have a market advantage. Any companies who move toward improving their GHG tracking will find the accounting practices in GHG Protocol’s Scope 3 Standard very useful.

Challenges of Tracking Scope 3 Emissions

There are two significant general challenges for tracking Scope 3 GHG emissions. The first, as we can see from the preceding discussion, is that there tend to be a large quantity of them. The second is that companies often lack proper awareness and visibility of these indirect emissions. It follows that they often aren’t tracking them, and so lack oversight over a source of GHGs that may well represent their company’s biggest contribution to climate risks.

Let’s consider how these challenges play out for two specific business sectors.

Manufacturing

The manufacturing industry produces a massive output of goods across its many subsectors, and understandably, the traditional management focus in the industry has focused on the flow of raw materials to finished products, and on making the process as efficient and lean as possible. But that focus on everything that happens within the manufacturing facility can prevent awareness of the full scope of the company’s operations and how those operations indirectly result in GHG emissions.

For example, a manufacturing facility usually runs on energy sources purchased from utility providers. If so, the GHG emissions associated with utility energy consumption would be Scope 2 relative to the manufacturing company. Not all organizations even have these Scope 2 emissions on their radar, and even many of those that do struggle through the process of collecting their utility data, ensuring that the right emissions factors are used, and calculating conversions to the units needed.

Manufacturing facilities can also generate large quantities of wastes, some of which may be hazardous wastes based on characteristics such as flash point or pH, or inclusion of chemicals on specific EPA lists (Lists F, K, P, and U). When the waste generator ships these wastes to a treatment, storage, and disposal facility (TSDF), the TSDF may treat the wastes in several ways, such as incineration, that generate GHGs classified as Scope 3 relative to the manufacturing company. Many EHS and business leaders are either not tracking these emissions at all or are having difficulty finding ways to track Scopes 1,2, and 3 GHG emissions using the same tools.

Financial/Banking

Picture a bank. You’re probably imagining a lobby, possibly with a large, stately looking clock, and maybe even a plaque on the wall with details about the bank’s history. There’s probably a row of bank tellers behind a counter, and some individual banker offices around the perimeter.

Now that you have a picture in your mind, think about this: where could the bank be generating GHGs in its operations? Well, there’s some electricity in use to keep the lights on, which would create Scope 2 emissions. If the bank is geographically located in a colder climate, there will be natural gas combustion, which will also result in Scope 2 GHGs. Beyond that, it might be hard to think of additional sources of GHG emissions for our bank.

So, let’s expand the picture by thinking about what banks do that creates impacts beyond the walls of the brick-and-mortar bank location. Banks loan money to businesses, who then use the money to finance growth, such as expansion of existing production lines or constructing new facilities. The companies receiving these loans will then have GHG emissions that are subsidized by the money borrowed. According to the GHG Protocol Scope 3 Standard, these emissions would fall under the final category of Scope 3 GHGs in the table above, in the downstream category of “investments.”

Karen Fang, Global Head of Sustainable Finance at Bank of America states in an interview on S & P Global’ s podcast ESG Insider that because of the inherent nature of banking discussed above, Scope 3 GHG emissions represent most of the industry’s contributions to climate risks.

In both examples, industry leaders would need to look beyond the obvious to identify how their operations indirectly result in GHG emissions. Knowledge of the GHG Protocol, especially its Scope 3 standard, can provide the background knowledge and accounting practices needed to accurately track and report GHGs.

Introducing ESG QuickTakes: A Sustainability E-Newsletter!

Master ESG with our NEW quarterly publication. Get expert insights on regulations, energy management, and sustainability delivered straight to your inbox.

GHGs in ESG Reporting Standards

Of course, a major challenge is that there are many different ESG reporting frameworks, which has created uncertainty for stakeholders, as well as for business leaders about which reporting framework to follow or would in some cases need to follow as a regulatory requirement.

Here’s just a sampling of reporting frameworks, some of which have emerged quite recently.

- SEC: As we’ve previously blogged about, SEC published a proposed rule on March 21, 2022 to require public companies to disclose certain information about their management of climate risks. The public comment period for the proposal closed on June 17, 2022.

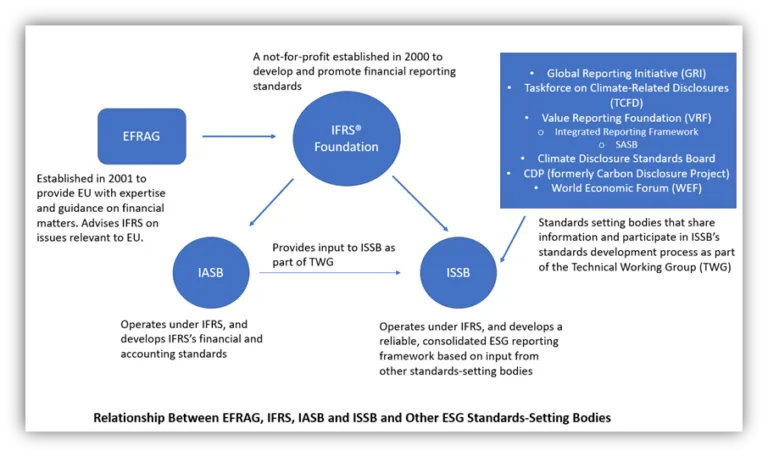

- International Sustainability Standards Board (ISSB): We’ve also previously blogged about the recent formation of the ISSB by the International Financial Reporting Standards (IFRS) Foundation, announced at United Nations Climate Change Conference (COP 26) in Glasgow, Scotland, UK in November 2021. The purpose of the ISSB is to bring more reliability and consolidation to ESG reporting frameworks, and to advance that purpose, IFRS Foundation created a technical working group (TWG) consisting of key representatives of other major reporting frameworks mentioned in this list. ISSB published its first two ESG standards, a General Standard and a Climate Standard, on March 31, 2022 and public comment period runs until July 29, 2022. ISSB has stated that they hope to finalize the standards before the end of 2022.

- Sustainability Accounting Standards Board (SASB): SASB has issued multiple general as well as industry-specific standards pertaining to common issues for those sectors. The history of SASB standards testifies to the growing consolidation of ESG frameworks in recent years. In 2021, SASB merged with the International Integrated Reporting Foundation (IIRF) to form a unified organization called the Value Reporting Foundation (VRF). As of June 22, 2022, the VRF and IFRS Foundation, the parent organization of ISSB, announced that they have a target date of August 1, 2022 to finalize a merger first announced at COP26 in late 2021. Oversight of SASB standards will transfer to ISSB after that date.

- Global Reporting Initiative (GRI): GRI develops “universal,” sector-specific, and topics-focused standards covering many aspects of ESG reporting, including GHG emissions. Recent GRI publications include Sector Standards for Oil and Gas (GRI 11), Coal (GRI 12), and Agriculture, Aquaculture and Fishing (GRI 13), all of which are now available for public use.

- European Financial Reporting Advisory Group (EFRAG): EFRAG has existed for two decades and has issued many financial standards over the years, working closely with the IFRS Foundation to ensure the latter’s standards reflect input from the European Union. As we discussed in a recent blog post, EFRAG published its first standards on different areas of ESG, including a Climate Standard requiring reporting of all three scopes of GHGs, on April 27, 2022. These standards, like SEC’s standards in the US, would be mandatory. They’d require ESG-related disclosures from tens of thousands of EU companies not currently making them.

The Big Picture on GHGs in ESG Reporting Frameworks

These may seem like a lot of ESG frameworks, and it’s easy to feel overwhelmed, but it’s important to remember a couple of key points.

The first is that the focus is increasingly on just a handful of reporting frameworks, like ISSB, SEC, EFRAG and GRI. There is a definite trend toward consolidation, with ISSB leading the way by assuming oversight of the SASB standards through consolidation with VRF, and their collaboration with TCFD. And even though there is a fundamental difference between ISSB and EFRAG in that the latter adopts a double materiality rather than a financial materiality framework, the existing relationship between IFRS Foundation and EFRAG will probably help these two standards frameworks move closer together over time. The fact that GRI actively advises both EFRAG and ISSB will likely help drive greater alignment, too.

The relationships between EFRAG, IFRS, IASB, and ISSB are mapped out below.

The second point is that there are definite commonalities across these standards, and one of them is that all of them entail identifying and tracking all three scopes of GHG emissions. As discussed, most business struggle with just recognizing, let alone tracking, all their Scope 3 GHGs. But if you’re going to get serious about pursuing ESG maturity, you’re also going to need to get a better handle on tracking and reporting all your GHG emissions, including all fifteen categories of Scope 3 GHGs identified by the GHG Protocol. Modern ESG software can help you track all your GHG scopes on a single platform and conduct materiality assessments to be sure you’re identifying and focusing on the right things.

Let VelocityEHS Help!

Our VelocityEHS ESG Software provides exactly the support you need. Track all three scopes of your GHG emissions, with reporting capabilities aligned with major ESG disclosure frameworks. Materiality assessment capabilities within the software also help you easily generate surveys you can share with stakeholders, so you be sure you’re identifying easier to miss issues such as categories of Scope 3 GHGs.

ESG is here to stay, so get the tools you need in place today to achieve and maintain ESG maturity. Request a demo or contact us today to learn more about how we can support your continuing ESG journey.