ESG Frequently Asked Questions

- What are the main drivers of ESG’s importance today? Why am I hearing about it so much?

- Are there regulations related to ESG?

- How do I get started in ESG?

- Can following or certifying to standards like ISO 14001 and ISO 45001 help build ESG maturity?

- What is a materiality assessment and why is it important?

- Are there different ways to determine materiality?

- How do I determine good ESG goals?

- We want to do better at tracking greenhouse gas (GHG) emissions. Can you give us a few simple guidelines to get started?

- What are the most important ESG metrics to track?

- How can we ensure accurate, reliable ESG data?

- I’ve heard this term “circular economy” mentioned in connection with ESG. Could you explain what that term means, and how it related to ESG maturity?

- It seems that whenever I read about ESG I’m really only learning about the “E,” for “environmental.” What about the “S” and the “G?” What are some of the important aspects of ESG related to “social” and “governance?”

- How does EHS & ESG software make pursuing ESG maturity easier?

1. What are the main drivers of ESG’s importance today? Why am I hearing about it so much?

This is one of the most frequent questions we get, because many EHS professionals and business leaders are understandably trying to make sense of all the additional attention ESG has been receiving over the past few years.

We can consider the two main drivers of interest in ESG to be investment and management. Let’s talk a little about each.

Investment. Arguably, investment decisions have been the major driver behind the mainstreaming of ESG over the last several years, because a growing volume of research and data demonstrates a relationship between higher ESG maturity and better financial performance. For example, a 2020 Harvard study found ESG performance to correlate with Economic Value Added (EVA) Margin, which is the incremental difference in the rate of return (RoR) over a company’s cost of capital. What that means in plain English is that companies with higher levels of ESG performance see a better return on their investments than companies with lower ESG maturity. The same 2020 Harvard study found that companies with the highest level of ESG performance had the lowest amount of volatility in business performance, defined as events that disrupted business continuity or caused a loss of a majority of shareholder value. According to the study, the reduced volatility is a function of avoiding the kind of significant events (e.g., fires, chemical spills, explosions) that can threaten employee health and well-being, disrupt business and undermine share price.

Management. The point about volatility above ties into another benefit of ESG maturity, which is better overall management. There are a couple of reasons why higher ESG maturity leads to improvements in general business management. One is that a company that achieves ESG maturity has arrived there only after improving engagement with all its stakeholders, which means there’s a wider, deeper well of good ideas to drive better management and business strategies. Another is that the “G” in “ESG” stands for corporate governance, which is a measure of how well a business is managed. Companies that establish ESG maturity need ethical practices and policies, sound financial incentivization plans for executives, and cybersecurity programs to protect the company’s IT infrastructure.

Putting all this together, a company that builds successful ESG programs will be better situated for financial success and organized well enough to continue growing and evolving in response to new challenges. An emergent property of such a business is agility, which we can think of as the ability to pivot operations in response to external challenges or pursuit of new opportunities. Think about everything that’s happened over the last few years, including the business and social disruptions caused by the global COVID-19 pandemic, and as of this writing, economic stresses caused by higher inflation rates and supply chain disruptions. Not all companies survived these challenges. Companies with mature ESG programs will, on average, have the best chance of seeing it through, and even prospering as competitors fail to weather challenges and capitalize on opportunities. They’ll reduce costs associated with energy consumption and waste management, improve their ability to secure loans and venture capitalist investments to fund future growth, and have the corporate governance and stakeholder engagement to stay agile.

2. Are there regulations related to ESG?

Yes, there are. While many people still think of ESG disclosure frameworks as being largely voluntary, there are in fact regulations addressing many aspects of ESG.

First, we shouldn’t forget that EHS is part of ESG, and there is a universe of EHS regulations that company leaders need to know about, many of which create significant work in terms of compliance obligations. For example, in the United States, OSHA issues regulations regarding workplace safety, some of which, such as the HazCom Standard and the Recordkeeping Standard, apply to most employers covered by the Occupational Safety and Health (OSH) Act of 1970. The HazCom Standard requires employers to maintain safety data sheets (SDSs) for all hazardous chemicals, a written Hazard Communication Plan, and a hazardous chemical inventory list, as well as to ensure that all containers containing hazardous chemicals are labeled and that all employees who work with these chemicals receive proper training. The Recordkeeping Standard requires many employers to document workplace injuries and illnesses that meet general or specific recording criteria on Forms 300 and 301, as well to complete, sign and post the Form 300A summary report from February 1 to April 30th of each year. A subset of those employers also needs to electronically submit 300A data to OSHA each year, and all employers covered by the OSH Act need to report certain serious workplace incidents directly to OSHA. There are analogous regulations in other jurisdictions, such as in Canada, which has the Workplace Hazardous Information System (WHMIS) Standard for chemical hazard communication and provincial worker’s compensation board requirements to report occupational injuries and illnesses.

Environmental regulations can create some of the largest compliance burdens for companies to manage, especially for companies that have large, complex facilities using bulk quantities of chemicals. Such a company may find that its operations have associated air emissions that require coverage under a Major Source/Title V air emissions permit from EPA in the US, and if so, they’d have a great deal of work to do calculating potential to emit (PTE), keeping records of material usages and emissions measurements, and submitting emissions statements. They may also be subject to process safety requirements such as EPA’s Risk Management Plan (RMP) rule, OSHA’s Process Safety Management (PSM) rule, or Control of Major Accident Hazards (COMAH) in the UK, water discharge permitting requirements, and hazardous waste management requirements.

An additional complication is that both safety and environmental regulations are continually changing. That’s true of many of the requirements mentioned above. OSHA, at the time of this writing, has already issued proposed rules to update the HazCom Standard and the Recordkeeping Standard, and Health Canada is also in the process of updating WHMIS. Companies not only need to be aware of the EHS regulations applicable to their operations but be on top of proposed changes and ready to meet shifting requirements.

Increasingly, global regulations are also going beyond traditional EHS requirements and are targeting ESG disclosures. In the US, Securities and Exchange Commission (SEC) issued a 2022 proposed rule that would significantly expand disclosures required of public companies. The proposal would require all publicly traded companies registered with the SEC to disclose information including:

- Their governance of climate-related risks and relevant risk management processes;

- How those climate-related risks identified by the company have had or are likely to have material impact on its business and financial performance, whether over the short-, medium-, or long-term;

- How the identified climate-related risks have affected or are likely to affect the registrant’s strategy, business model, and outlook;

- The impact of climate-related events (such as severe weather events and other natural conditions) on specific line items within the company’s consolidated financial statements, as well as on the financial estimates and assumptions they use in those statements; and

- Whether the company has adopted a climate transition plan as part of its climate risk management strategy. A climate transition plan describes the company’s specific greenhouse gas (GHG) emission reduction goals, and how they will pivot their operations and business model to achieve those goals.

In the EU, European Financial Reporting Advisory Group (EFRAG) has gotten in on the act by issuing draft ESG disclosure standards. The European Commission’s acceptance of a proposal for a Corporate Sustainability Reporting Directive (CSRD) in April 2021 set the table for these standards. The CSRD updates disclosures required by the Non-Financial Reporting Directive (NFRD), the current EU sustainability reporting framework, which sets disclosure for non-financial and diversity information by certain large companies. The CSRD proposal extends the scope to all large companies and all companies listed on regulated markets (except listed micro-enterprises), requires the audit (assurance) of reported information, introduces more detailed reporting requirements, and sets the stage for development of a specific sustainability reporting standards.

EGRAG is the organization delegated with the authority to develop the new standards envisioned by the CSRD proposal, and they’ve made good on that responsibility by publishing their first draft standards in 2022. The draft standards would require tens of thousands of European companies that don’t currently make disclosures to begin submitting them and require audited assurance of the information reported. The important thing to understand is that the disclosures would also be much more detailed than those submitted by EU companies currently required to submit data and would address many aspects of ESG. In addition to data about emissions of all three scopes of ESG and its plans for addressing climate risks and opportunities, companies would need to disclose data that includes (but is not limited to) their contributions to water and air pollution, their potential impacts on biodiversity and water/marine resources, and their management of workers in the value chain, both downstream and upstream of their operations.

Even standards largely thought of as voluntary can become mandatory if a municipal government decides to adopt them via a regulatory process. One example of that is New Zealand’s adoption of the Task Force on Climate-Related Financial Disclosures (TCFD) framework as a mandatory reporting system for climate risks.

The key takeaways from all this are that yes, there are regulations pertaining to both EHS and ESG, and that it’s important for you to determine whether they cover your business. If they do, you will at a minimum need to develop plans to address your climate risks and opportunities and start tracking and reporting all three scopes of your GHG emissions. But you should also be mindful that stakeholders are increasingly demanding more accountability in all areas of ESG, including social sustainability and pay equity, regardless of whether you’re currently subject to regulations requiring disclosures in those areas.

3. How do I get started in ESG?

We’re getting that question quite a bit, because it seems that many EHS professionals are learning about ESG and are either being “voluntold” to manage their company’s ESG programs or realizing there are many professional development opportunities and career pathways open to the professional who makes the effort to learn about ESG. While there’s no universally applicable answer to this question, we can give a few tips based on our own subject matter expertise and awareness of common organizational pain points.

First, master the foundation of EHS. As you know, you already have plenty of EHS tasks to manage, like investigation of injuries, development and tracking of corrective actions, management of safety meetings and training, inspections, keeping up with your chemical management and hazard communication responsibilities, and completion of reports, some of which may stem from regulatory requirements. Many EHS professionals are struggling to manage these tasks without the tools or support they need, which makes it difficult if not impossible to start taking on additional ESG projects.

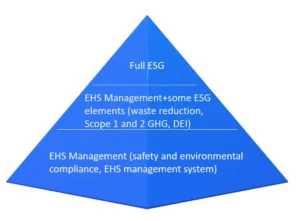

You can think of your responsibilities as a hierarchy – kind of like social psychologist Abraham Maslow’s famous “hierarchy of needs.” Maslow reasoned that peak human performance, which he referred to as “self-actualization” or “flow,” was only reachable for any given person if she were able to meet her basic needs first, like having shelter and food and water. Analogously, you can only reach ESG maturity if you’ve established a solid foundation in EHS management, as shown in the “ESG pyramid” below.

Most companies are somewhere in the bottom or middle parts of the pyramid – in fact, in a poll we recently conducted during a webinar, only 5% of respondents self-reported as having a “robust, mature ESG program.” To achieve and sustain ESG maturity, you’ll need efficient ways of managing EHS. Modern EHS software can help there, by helping you share responsibility for your most important EHS tasks, streamlining your chemical and SDS management, and giving you seamless access to your data so you can more accurately assess your performance and make better decisions.

When you think you’re ready to take the next step toward ESG maturity, your next move should be to identify your stakeholders. First, you must determine who counts as a stakeholder for your company and your operations. From an ESG perspective, the term “stakeholder” really includes anyone, inside or outside of your organization, who affects, is affected by, or perceives themselves to be affected by your company’s actions. That means it includes the executive team but also front-line workers, it includes temp workers and contracted workers, it includes your suppliers, distributors and other value chain partners, and it includes community organizations and regulatory bodies. Carefully determine who has information relevant to your current and future ESG performance, and then start fostering relationships and communications with those parties.

The stakeholder identification step is so important precisely because everything else you’re going to do on your journey depends on it, including conducting a materiality assessment (discussed a little later in this FAQ). You need the perspectives of your stakeholders to ensure that your understanding of your ESG performance and the factors affecting it are well-grounded, because otherwise, you’re not going to be able to focus on the right things or build effective ESG management strategies.

4. Can following or certifying to standards like ISO 14001 and ISO 45001 help build ESG maturity?

The International Organization for Standardization (ISO) develops some of the most widely used global standards outlining guidelines and general practices for many areas of business management. The standards they publish that end with a “1” are intended to be used by businesses for certification purposes – meaning that they go through a multistep process of improving their management practices to confirm they have the elements in place required by the standard, then undergoing certification audits by accredited third party organizations. Other ISO standards that don’t end in a “1” can be used for guidance purposes, often in conjunction with a major standard.

Two very relevant ISO standards in the EHS & ESG worlds are:

- ISO 14001: the international standard for Environmental Management Systems (EMSs).

- ISO 45001: the international standard for Occupational Health & Safety (OH &S) management systems.

Both standards have a few traits that make them very useful as roadmaps for navigating the pathway from EHS to ESG. For instance, they task an organization with looking at the full context of their operations to determine factors that can affect their environmental or OH & S performance, and ISO 45001 additionally stresses the importance of “consultation and participation” of all workers – not just managerial level employees. These are important preparations for identifying and engaging stakeholders. Both standards also stress the importance of identifying the key aspects and impacts of your operations for safety and environmental performance, which dovetails nicely with and can help shape the completion of an ESG materiality assessment. Finally, 14001 and 45001 provide guidance on how organizations can develop good objectives with specific numerical targets based on their assessment of aspects and impacts, which is really where a sound ESG strategy development process needs to start. In all these ways – taking a broad view of organizational context, development of efficient processes, and building engagement with stakeholders – these ISO standards can help an organization advance further in its path to ESG maturity.

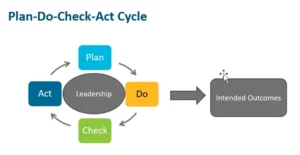

Still, it’s important to remember that earning an ISO certificate is no guarantee that you’ve permanently conquered every obstacle and have sustainable processes for maintaining your programs. Many organizations, unfortunately, develop a “one and done” mindset when it comes to pursuing certifications – once they get the certificate, they frame it, nail it to the wall, and then let their systems erode until it’s coming time for a surveillance audit. The ISO standards themselves, by contrast, highlight the importance of a continual improvement process and the Plan-Do-Check-Act (PDCA) cycle, which models a feedback loop of ongoing reassessment of our management system components followed by making the necessary revisions.

If you not only go through the process of using 14001 and/or 45001 to achieve certifications but see your management systems as living, evolving things, you’ll probably have more success in your own ESG journey.

5. What is a materiality assessment and why is it important?

The easiest way to think of materiality is as a relevancy filter for the issues that matter most to an organization. That information is considered “material” – or relevant – if it could influence the decision-making of stakeholders regarding the company. The exercise of determining what issues are material to your organization is called a materiality assessment.

This might sound like a great place to begin your whole ESG strategy, (and you’d be right) but it doesn’t always play out that way. Many organizational leaders decide to pursue specific ESG goals, often based on a choice of ESG reporting framework, without sitting down to figure out whether those goals are the most relevant ones for their company and their operations. This can lead to several less-than-ideal situations, like over-reporting, or ignoring the risks and opportunities that could make the biggest impact on your own company’s ESG performance.

In other words, if you don’t start with a materiality assessment, you’re letting other people who don’t know the specifics of your company determine what’s relevant for you. It makes more sense to take ownership of that yourself and conduct an assessment that captures the specific risks and opportunities for your business and sets you up for success.

6. Are there different ways to determine materiality?

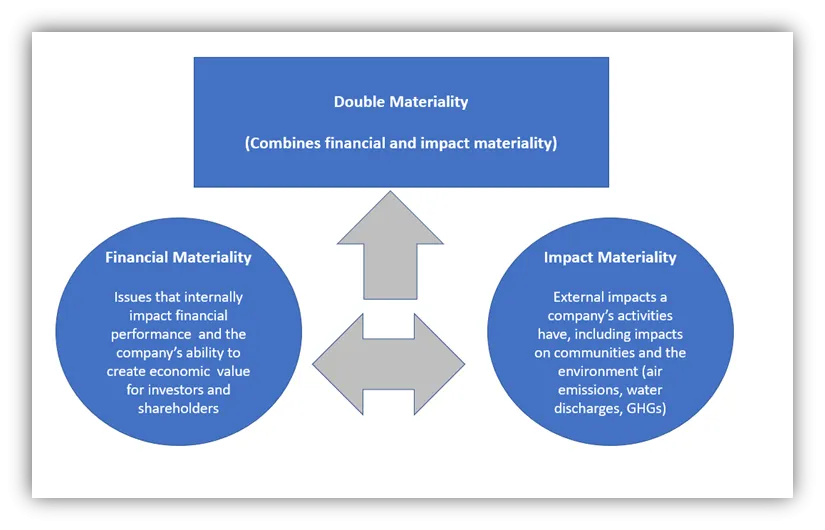

In ESG circles, the two main ways of thinking about that break down into financial materiality and impact materiality.

Financial materiality is about economic value-creation – it’s focused on the issues that internally impact a company’s financial performance and its ability to create economic value for investors and shareholders. This is the definition of materiality adopted by the International Sustainability Standards Board (ISSB), an organization formed by its parent entity, the International Financial Reporting Standards (IFRS) Foundation, in late 2021.

For example, in its draft standard on General Requirements for Disclosure of Sustainability-related Financial Information, ISSB states that information is material if omitting, misstating or obscuring that information could reasonably be expected to influence decisions that the primary users of general-purpose financial reporting make on the basis of that reporting, which provides information about a specific reporting entity.” In other words, data is financially material if it is needed to form an accurate picture of the financial health of a company and its potential value to investors.

Impact materiality focuses on the external impacts an organization’s activities have, including impacts on communities and the environment. According to the European Financial Reporting Advisory Group (EFRAG), “a sustainability matter is material from an impact perspective if it is connected to actual or potential significant impacts by the undertaking on people or the environment over the short-, medium- or long-term. This includes impacts directly caused or contributed to by the undertaking in its own operations, products or services and impacts which are otherwise directly linked to the undertaking’s upstream and downstream value chain, and not limited to contractual relationships.”

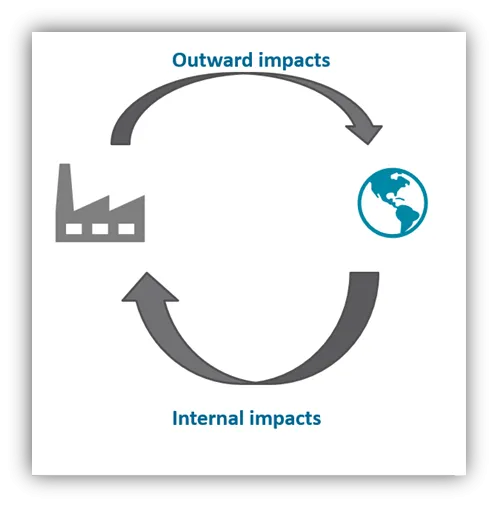

It should be apparent that these two types of materiality are not mutually exclusive, because some issues create both internal financial risks and external impacts. For example, a company that has an uncontrolled release of a hazardous chemical would certainly create external impacts on the local community, potentially on organisms in water and soil, and might also be opening themselves up to regulatory violations and associated penalties, or financial losses from civil suits. And a company with a high intensity of GHG emissions may be contributing to climate risks, including severe weather events that can damage their facilities or disrupt supply chains. This dynamic interplay between internal impacts and outward impacts is shown in the figure below.

The relevance and interconnectedness of both impact and financial materiality is the reason for the growing importance of the concept of double materiality, which combines both perspectives. The relationship among financial materiality, impact materiality and double materiality is shown in the figure below.

A double materiality perspective casts the net wide and counts any issues as material if they’re relevant from either perspective.

As Global Reporting Initiative (GRI), one of the premier ESG standards-developing bodies in the world puts it:

“Double materiality is the union … of impact materiality and financial materiality. A sustainability matter meets therefore the criteria of double materiality if it is material from either the impact perspective or the financial perspective or both perspectives.”

One challenge is that different ESG disclosure standards use different materiality frameworks. For example, ISSB’s two draft standards use an impact materiality framework, while EFRAG’s draft standards use a double materiality framework. The different definitions of materiality used in different frameworks, and variations in the issues that will matter most across different organizations and operating locations, mean that you’re going to need to be agile to need to meet the likely evolving materiality assessment needs for your company. That will be easier if your tools are agile, too.

Modern ESG software that simplifies materiality and double materiality assessments can provide just the support you need. ESG Software from VelocityEHS enables you to quickly build materiality surveys from materiality or double materiality perspectives. Our software makes it easy to select ESG survey topics from a drop-down list, share it with stakeholders inside or outside your organization, and summarize your results in the form of a materiality matrix so everyone involved in your ESG program can understand the issues that matter most to your organization.

7. How do I determine good ESG goals?

Your ESG goals are going to depend on your materiality assessment, discussed earlier in this FAQ. To put it simply, you need a good understanding of your most important issues before you can determine your most relevant goals. From there, you can get more granular and select measurable numerical “targets” to pursue, and programs to achieve them.

For example, if you’ve determined that you consume a higher-than-average amount of electrical energy at your operating headquarters, it would make sense to make reduction of electricity usage at that facility an important goal, or objective. Then you can set a numerical target, such as reducing electricity usage by 10% relative to a baseline and identify a program to accomplish your objectives and targets, like use of smart metering. You’ll also need to identify and track the appropriate metrics to measure your performance, which shows the close connection between metrics and goals.

As we mention in the discussion of metrics later in this FAQ, you may also find that it makes sense for your organization to base its goals at least in part on external factors, such as the applicability of specific regulations to your operations, or stakeholder pressure to follow specific ESG disclosure frameworks. These kinds of considerations don’t displace your own materiality assessment process as much as they add additional color and context to it, because it’s potentially broadening the pool of relevant stakeholders and the range of ESG issues to include in your materiality assessment survey.

8. We want to do better at tracking greenhouse gas (GHG) emissions. Can you give us a few simple guidelines to get started?

Sure thing. You’ll have a lot of knowledge to absorb as you get deeper into tracking and reporting GHGs, but we can give you a few guidelines to help you get going.

- Be familiar with GHG Protocol. and especially its standard for value chain/Scope 3.

The GHG Protocol designed the Corporate Standard to help companies prepare a GHG inventory that represents a true and fair account of their emissions, to improve transparency in GHG accounting, simplify and reduce the costs of compiling a GHG inventory, and provide information to help businesses build an effective strategy to manage and reduce GHG emissions and participate in both voluntary and mandatory GHG programs.

Companies structuring their management of GHGs according to the Corporate Standard would need to track the following sources, or scopes, of GHGs:

- Scope 1: Direct emissions from owned or controlled sources

- Scope 2: Indirect emissions from the generation of purchased energy consumed by the reporting company

- Scope 3: All other indirect emissions that occur in a company’s value chain

The Scope 3 standard is a supplement to the GHG Protocol Corporate Standard, and users should reference that document when using it.

The Standard defines Scope 3 GHG emissions as “all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.”

Upstream emissions, according to the Scope 3 Standard, are defined as indirect GHG emissions related to purchased or acquired goods or services. Downstream sources are indirect GHG emissions related to sold goods and services.

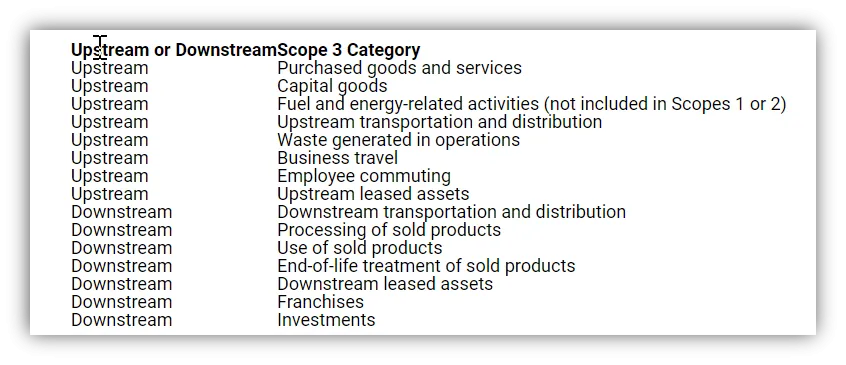

The Standard categorizes Scope 3 emissions into fifteen distinct categories, classified as either “downstream” or “upstream” relative to the company, as shown in the table below.

As the above table shows, there are many different sources of Scope 3 GHG emissions upstream and downstream of a company’s operations. In fact, Scope 3 emissions often represent the largest source of emissions for companies and are associated with the most significant opportunities to influence GHG reductions and achieve GHG-related business objectives.

It’s also important to understand that while the GHG Protocol itself does not establish regulatory requirements to track Scope 3 GHGs, there are ESG frameworks that do. For instance, the proposed Securities and Exchange Commission (SEC) rule in the US would require publicly traded companies to track Scopes 1 and 2 GHGs, and Scope 3 GHGs if determined to be financially material – meaning that they could impact financial performance and decisions made by shareholders and investors.

- Determine which regulations and standards are important to you. While the GHG Protocol itself doesn’t establish regulatory requirements, other existing and proposed regulations refer to and presuppose knowledge of the GHG Protocol for purposes of inventorying and tracking GHGs.

There are voluntary ESG disclosure standards out there that, due to marketplace recognition or perceived importance to your stakeholders, might make sense to follow. As discussed elsewhere in this FAQ, there are also mandatory existing and proposed ESG standards that may cover your business. It’s important to understand which standards apply, and which are mandatory. But whether you’re going to be following a standard because company leadership decides you will or because a regulatory agency requires that you do, you’re going to need to identify your sources of GHG emissions across all three scopes and start tracking them.

- Start inventorying all scopes of GHGs. This is where having familiarity with the GHG Protocol, and especially their Scope 3 Standard, is going to be a big help to you. You’ll also benefit from having the collective insights of your stakeholders regarding the full context of your operations, so you’ll be able to identify downstream and upstream Scope 3 GHG emissions. Remember, Scope 3 emissions by their nature are out of sight and so often out of mind, and can be harder to track, but major disclosure frameworks agree on the importance of tracking them to ESG accountability and maturity.

- Share and review your metrics. If you’re covered by a mandatory ESG disclosure framework, you’ll need to not only track GHG metrics but also submit formal reports. For example, SEC’s proposed ESG disclosure rule in the US would require companies to submit GHG emissions data on its existing registration statements and periodic reports, such as on Form 10-K.

But even if you’re not required to submit your GHG metrics to an external agency, you’re still going to need to review and share your data internally with stakeholders so you can assess your performance against objectives and make the necessary changes to stay (or get back on) track. A big part of the battle is having an efficient way to collect data for all three scopes of GHG emissions, and from there, to perform the calculations and reporting your organization needs.

Our VelocityEHS ESG solution gives you the support you need in all aspects of GHG tracking. We provide a single platform for tracking and collecting data for all three scopes of GHG emissions, with reporting capabilities aligned with CDP, GRI, and SASB. It’s the simple way to do ESG right.

9. What are the most important ESG metrics to track?

There’s no one-size-fits-all answer to that question. Your own answer will depend on a couple of factors, including your materiality assessment results, and whether you already know you’re covered by specific regulations and disclosure standards.

In general, you need to be aware of what ESG regulatory requirements cover your operations. As we’ve seen, there’s a growing trend toward mandatory ESG disclosures, such as those proposed by the SEC in the US and by EFRAG in the EU. If you know you need to track (and report) certain ESG metrics because of these regulations, those metrics will move straight to the top of your list in terms of importance.

All of the major existing and proposed mandatory ESG disclosure frameworks require tracking of all three scopes of GHGs, as well as having a climate transition plan in place detailing how the company is addressing climate risks and opportunities, and the methods used to assess them.

Otherwise, a lot is going to depend on the issues determined by your materiality assessment to be most important to your organization, your stakeholders and your ESG performance. Even so, it would be wise to keep your ears to the ground about the evolution of ESG, and the metrics it seems that a growing number of ESG stakeholders are placing importance upon. That’s because issues that may not seem important to you now may seem important in the future if your customers, financial investors and value chain partners demand a demonstration of your company’s performance in those areas.

10. How can we ensure accurate, reliable ESG data?

Concerns about ESG data integrity and reliability are one of the driving forces behind the push for better and more consistent ESG metrics, which has resulted in the formation of the International Sustainability Standards Board (ISSB) and the publication of its first draft standards. All stakeholders, from investors to consumers to members of communities, demand that disclosures contain reliable metrics that enable accurate evaluation of a company’s ESG performance.

How can companies serious about pursuing ESG maturity improve their data? It starts with improving the accuracy of the raw data they’re collecting in the first place. For example, our VelocityEHS ESG solution offers utility integration capability, in which software pulls energy data directly from the utility provider, eliminating the need to hunt down physical copies of bills and the potential for manual data entry errors. Software like the VelocityEHS ESG Solution also helps through a calculation engine that converts your utility data into the units you need, and automatically applies the correct emission factors.

From there, it’s important to ensure that you’re correctly reporting your data and have an easy way to share data with stakeholders, to improve its visibility and improve the likelihood of identifying potential issues. Our VelocityEHS ESG Solution quickly compiles your data into reports aligned with major disclosure frameworks like SASB, GRI, and CDP, and helps you have the better, more transparent reporting your stakeholders demand.

11. I’ve heard this term “circular economy” mentioned in connection with ESG. Could you explain what that term means, and how it related to ESG maturity?

The term circular economy refers to a lifecycle approach to production focused on eliminating wastes and keeping products in use for as long as possible through reuse, repair/refurbishment, and recycling. This is the next step beyond typical waste minimization and on-site recycling strategies many companies use to reduce their overall volumes of waste generated. As you move your waste management practices farther toward ESG maturity, you’ll be well-prepared to pivot your business operations toward a circular economy model.

For example, a facility that manufactures goods sold in commerce would not only capture and re-use materials that would otherwise have become hazardous wastes but would also intentionally design products that can remain in use for longer, thereby reducing the need to consume additional resources in manufacturing new product, and which is as unharmful as possible to human health and the environment at the end of its lifecycle. This means that sustainable procurement is a key consideration here. A central aspect of sustainable procurement is to look beyond short-term needs and consider factors such as social responsibility and impacts on the environment and communities.

An example of sustainable procurement would be reviewing options for raw materials, enabling manufacture of products that can remain in use for longer periods of time, in accordance with circular economy principles. Another example involves performing risk assessments of chemical hazards and selecting safer and more environmentally responsible formulation components that will not become hazardous wastes at the end of their lifecycle.

“Green Chemistry” is a term often used for the systematic review of chemical options to make safer and more sustainable choices. Modern EHS & ESG software can help here, enabling company leaders to conductive predictive risk profiling for chemicals quickly and easily, and identify safer alternatives.

To do sustainable procurement successfully, you also need good communication and cooperation with your supply chain partners. Be sure to include them among the stakeholders in your materiality assessment and share the results with them to enable a shared understanding of goals and priorities. Modern ESG software simplifies the process of creating a materiality assessment from a drop-down list of important ESG topics and summarizing the results in the form of a materiality matrix that makes it easy for all stakeholders to understand the most important ESG issues. It’s the easy way to evaluate and communicate the importance of issues such as sustainable procurement, and to do EHS & ESG right.

12. It seems that whenever I read about ESG I’m really only learning about the “E,” for “environmental.” What about the “S” and the “G?” What are some of the important aspects of ESG related to “social” and “governance?”

There’s definitely something to that observation. Many conference talks and journal articles on ESG talk quite a bit about GHGs and climate risks and might touch on a few other environmental topics. This priority is also reflected across global stakeholders – as previously mentioned in this FAQ, the commonality across different disclosure frameworks is that all of them entail tracking and reporting all three scopes of GHGs, as well as having a climate transition plan that describes how the business is addressing climate risks and opportunities.

But it would be a serious mistake to conclude that only the “E” in “ESG” is actually important. Let’s take a closer look at some of the issues included within the “S” and the “G,” and why they’re crucial to ESG performance.

“S”:

Earlier in this FAQ, we talked about the foundational importance of EHS to achieving and sustaining ESG maturity, and workplace safety is a big part of EHS responsibilities. In fact, at any given time, most of an EHS professional’s responsibilities might comprise safety tasks, such as investigating and documenting injuries and other accidents, performing inspections, tracking and following up on corrective actions, and managing your safety data sheet (SDS) library and hazardous chemical inventory. This is especially true because some safety regulations, like OSHA’s HazCom Standard and Recordkeeping Standard in the US, are applicable to many if not most workplaces.

But the “S” in “ESG” goes well beyond occupational safety and health and regulatory compliance. One area that’s increasingly important is social sustainability, which refers to the aim of creating successful places where people both live and work, both inside and outside the workplace. Inside the workplace, one of the most important elements of social sustainability is ergonomics, which by definition is about fitting the design of the workplace to the worker. While ergonomics hazards are to some extent addressed by EHS regulations, such as under the OSHA General Duty Clause in the US, is also central to any effective approach to managing workplace safety and employee health and wellness, because it helps us focus on the diversity of body sizes and physical abilities in our workplace, and so it contributes to accessibility and psychological safety. Similarly, physical demands analysis (PDA) is an important tool enabling employers to evaluate the physical capabilities of individual employees, including through post office employment testing (POET), to make sure that employees won’t have the physical and psychological stresses of having to perform job duties beyond their physical abilities. Modern ergonomics and health software can help ensure you’re taking your internal social sustainability management efforts to the next level.

A commitment to social sustainability also entails focusing on the ways your operations impact communities. One consideration pertains to your relationships and policies regarding workers in the value chain – workers who aren’t part of your own workforce (i.e., they don’t collect a paycheck from your company) but who work downstream or upstream of your operations and can be affected by them. Suppliers, transporters, and retailers are common examples of value chain workers. Because a company’s operations can create risks for value chain workers, a growing number of business and ESG stakeholders now insist that organizations take ownership of those risks and account for them in formal business plans. In fact, the proposed EFRAG standards issued in 2022 include an entire standard regarding workers in the value chain that would create mandatory requirements for many EU companies to develop plans addressing their management of risks related to value chain workers.

Another social sustainability consideration involves the direct impact of a company’s operations, from procurement of raw materials to disposal of wastes, emissions of air pollutants and discharge of water contaminants, on communities. An obvious point here is that organizations need ways to improve basic environmental management, including identification and quantification of their air emissions and water discharges and responsible cradle-to-grave management of their hazardous wastes. But another important aspect centers on sustainable procurement – making sure that the ways in which we source our raw materials is equitable and doesn’t (for example) contribute to local political conflicts, and also involves thorough assessment of health and environmental risks of chemical ingredients, so that we make the most responsible choices. For instance, taking sustainable procurement seriously means selecting materials that, as much as possible, lead to more durable products that remain in use longer and can more easily be refurbished or recycled – a key tenet of a circular economy business approach. It also means choosing ingredients to avoid or at least minimize exposure risks to employees, value chain workers, and end users, and reduce volumes of nonrecyclable and hazardous wastes. “Green chemistry” software that simplifies risk assessment of various chemical ingredient options can help support more informed decision making.

“G”

The” G” in “ESG” generally pertains to corporate governance, which is a measure how well-managed a company is. There are many facets here to consider. For example, is there evidence that ESG initiatives are truly integrated with a company’s business plan? Is executive compensation tied to achievement of ESG objectives and targets? Is there oversight and assurance of business practices to maintain transparency and ethics? And if the company is making ESG disclosures, are the disclosures complete and accurate? As discussed earlier in this FAQ, EHS & ESG software can help with this, by improving the collection and accuracy of data and helping to complete reports aligned with major ESG disclosure standards.

Another facet of corporate governance that’s sometimes overlooked involves cybersecurity. It’s fair to note that for some industries, such as software companies, cybersecurity is also part of the “S,” because it can have a huge impact on their customers. But data loss or cyberattacks are relevant to corporate governance when it comes to the company’s own data and IT infrastructure, because they can potentially cause business disruptions and major potential associated costs. Modern cloud-based software as a service (SaaS) EHS & ESG platforms help improve cybersecurity and business continuity by storing your data off-site, where it’s not vulnerable to damage to your physical facility structures and is managed in accordance with strict security guidelines such as SOC 2.

13. How does EHS & ESG software make pursuing ESG maturity easier?

If you’ve been reading this entire FAQ, you’ve probably picked up on some of the main takeaways here already. But for the benefit of anyone who’d like a handy bulleted list:

Mastering EHS. You can’t do ESG right unless you’re already managing EHS well. Modern EHS software can make this much easier, by helping you share responsibility for key tasks like incident investigations, management of corrective actions, and inspections, giving you a single platform for storage and access to all of your SDSs, and improving your access to key safety metrics.

Materiality. Conducting a good materiality assessment helps get your ESG management programs on the right foot by helping you tap into internal and external stakeholder knowledge and be sure you’re focusing on the most impactful issues to your organization. Modern ESG software simplifies the process of creating a materiality survey from a list of ESG topics, deploying it to your stakeholders, and then sharing results in the form of an intuitive materiality matrix, so everyone involved in your ESG management systems understands your most important issues and can begin developing the right goals and strategies for your organization.

GHGs. A commonality across ESG disclosure frameworks is that all of them require tracking of all three scopes of GHGs. Scope 3 GHGs, representing emissions from sources upstream or downstream of an organization’s operations and beyond their direct control, tend to be “out of sight, out of mind” and tougher to track. Modern ESG software helps by facilitating the tracking of all three GHG scopes in a single platform.

Data and Reporting. Collection of accurate data is important to ESG management in general, as well as a crucial aspect of corporate governance. ESG software can help via utility integration, reducing the potential for manual entry errors by pulling data directly from the utility provider. From there, calculation engines apply the correct emissions factors and can generate reports aligned with major ESG disclosure frameworks.

Social Sustainability. Ergonomics software using powerful Artificial Intelligence (AI) capabilities can help you assess and control ergonomics hazards throughout your workplace. Health software with PDA capabilities helps you protect the physical and psychological health of your workforce by preventing workers from taking on job tasks beyond their personal physical capabilities as measured by valid and reliable tests. And Green Chemistry tools help us take sustainable procurement into account, so that we’re making the safest and most environmentally responsible choices of raw materials to produce our goods and services.

Data security. Modern cloud-based software protects your most important data, helping ensure business continuity and better corporate governance.

And those are just some of the ways the world-class EHS & ESG software in our Accelerate ® Platform can help you. If you’re looking for more information, please be sure to follow us on LinkedIn, where you’ll encounter frequent updates on the worlds of EHS & ESG. And if you’re ready to learn more about how we can help you become safer and more sustainable, please feel free to request a demo today.