Over the last couple of years, Environmental, Social and Governance (ESG) has become the new standard of excellence for business and EHS management, and many leaders and industry professionals are still struggling to adapt. That’s understandable, because many are still struggling with traditional EHS management due to lack of efficient ways to complete and share responsibility for key management tasks. Compounding the problem, many people, including some in the ESG space, don’t realize the foundational importance of traditional EHS management to building ESG management strategies.

Without a robust system for managing EHS that’s continuous with our ESG management approaches, achieving and sustaining ESG maturity are out of reach. In what follows, we’ll introduce the concept of an ESG pyramid showing how ESG management builds and depends upon EHS management.

What is ESG?

First, let’s cover some background on what ESG is, and its rising importance to companies around the world.

You’ve probably heard terms like “sustainability” and “corporate responsibility” before. The first pertains to an organization’s efficient use of natural resources, and its active reduction of harm to the natural environment and to communities. The second term generally encompasses an organization “doing the right thing” – a concept that includes sustainability but also community involvement, ethical business practice and commitment to the greater good, rather than an exclusive focus on profit.

ESG includes and expands upon these topics, bringing in other stakeholder concerns, many of which have become recognized goals in global frameworks such as the United Nations (UN) sustainable development goals. A synopsis of issues under the ESG umbrella includes:

Environmental:

This category encompasses compliance with existing environmental regulations, including (in the US) EPA regulations such as the Clean Air Act, the Clean Water Act, Emergency Planning and Community Right-to-Know Act (EPCRA), and Resource Conservation and Recovery Act (RCRA), and associated requirements such as air and water permits, hazardous waste management, and chemical reporting such as Tier II reports and Toxic Release Inventory (TRI)/Form R reporting. It also includes measurement of greenhouse gas (GHG) emissions that contribute to climate change, whether or not they come from operations under the organization’s direct control (e.g. process emissions) or from utility consumption, or from offsite sources such as the treatment storage and disposal (TSDF) facilities that treat the facility’s waste. It should be noted that there’s a growing trend toward mandatory disclosure of GHG emissions and associated climate risk information, such as whether a company has implemented a climate transition plan, as evidenced by the Securities and Exchange Commission (SEC) 2022 proposed rule that would require climate-related disclosures from public companies. Plus, the environmental category includes the company’s efforts to reduce its energy and water consumption, reduce volumes of hazardous waste generated, improve its recycling and reduce amounts of waste sent to landfill, to reduce consumption of non-renewable resources, and to consider the broader ecological and environmental impact of its operations.

Social:

This broad category basically pertains to how the organization treats people, whether they’re inside or outside the company’s walls. It includes compliance with safety regulations such as those issued by OSHA in the United States, as well as its following of industry best practices for safety. There is also a focus on human capital, which includes a wide range of practices related to its workforce, such as handling of labor issues and compliance with labor laws, psychological safety and management of psychosocial risks, and commitment to the continuing education and skills development of its workforce. (Note: The Securities and Exchange Commission (SEC) has stated that they consider human capital a significant material risk and increased disclosure requirements regarding it, effective November 2020). It includes the company’s quality management process and how well it manages the safety of its products and services, and the company’s interaction with an impact upon its community and the world. For example, one social focus might be whether there is reliance on exploitative overseas labor practices, or sourcing of raw materials from regions where the sourcing may contribute to political oppression.

Governance:

This category is based around how well a company is managed and how well it abides by ethical practices at all levels. Some of the aspects covered in this category include compensation plans, including the gap between executive compensation and other employee compensations, and whether executive compensation is tied to achievement of ESG-related goals such as sustainability performance. Other considerations for governance may be compliance with applicable financial and tax regulations and the transparency of associated records.

Introducing ESG QuickTakes: A Sustainability E-Newsletter!

Master ESG with our NEW quarterly publication. Get expert insights on regulations, energy management, and sustainability delivered straight to your inbox.

The Rising Importance of ESG

As we can see, the concept of ESG is not really new, because it builds on concepts and goals that already existed. What is new is that plenty of data is now available, showing that high levels of ESG performance are correlated with better business stability and greater profits.

For example, a 2020 Harvard study found ESG performance to correlate with Economic Value Added (EVA) Margin, which is the incremental difference in the rate of return (RoR) over a company’s cost of capital. What that means in plain English is that companies with higher levels of ESG performance see a better return on their investments than companies with lower ESG maturity.

Better ESG performance is not only associated with greater profitability, but also with the avoidance of the kind of significant events (e.g. fires, chemical spills, explosions) that can threaten employee health and well-being, disrupt business and cause major drops in share price. The same 2020 Harvard study mentioned above found that companies with the highest level of ESG performance had the lowest amount of volatility in business performance.

These two trends, of higher profitability and lower volatility as a function of ESG performance, are related. As Jan Erik Saugestad, chief executive of Storebrand Asset Management puts it, “ESG factors are not just ‘nice to have’ but drivers of outperformance. It is both right and smart to exclude certain business practices in violation with well recognized conventions or with inherent high risk and negative impact.”

Growing awareness of these trends in the financial sector is also driving investment in companies with high ESG performance. Many major financial firms now offer investment assets with portfolios of companies ranked highly for ESG performance, and the flow of dollars into those assets has accelerated in the past couple of years. The US ESG fund landscape saw $15.7 billion in net inflows during Q3 of 2021, coming on the heels of the record $21.5 billion in Q1 2021. And according to another source, a record $649 billion poured into ESG-focused funds worldwide through late 2021,a significant jump from the $542 billion and $285 billion that flowed into these funds in 2020 and 2019, respectively.

Building Your ESG Pyramid

We can see that making the pivot toward ESG management is more important than ever. So the question is, how do we go about doing that, and maintain ESG maturity once we do? Many businesses are concentrated only on building an ESG approach, not on maintaining it, which is why their stint as “ESG mature” organizations will probably be short lived.

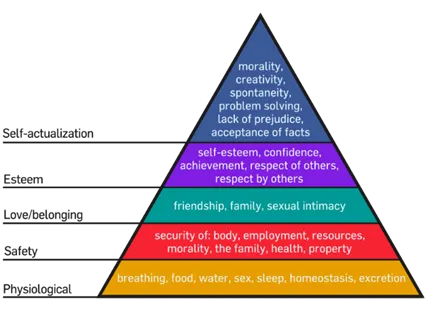

To understand why this is, let’s look at psychologist Abraham Maslow’s famous “hierarchy of needs” pyramid as an analogy, shown below.

The top of the pyramid represents characteristics that Maslow often referred to as “self-actualization,” the highest level of human motivation and thought of it as the achievement of the “ideal self.” In everyday language, we often refer to this state using phrases like “peak performance” or “being in the zone,” or in really modern vernacular, being in “beast mode.” It means we’re at our best, at or near the top of our game, and there’s usually a feeling of pride and motivation in this state that makes us want more of it.

But we need to remember that the top of the pyramid only remains in place if the bottom is stable. That’s where our basic human needs, like food, shelter, and health and access to healthcare are found. You can’t self-actualize if you’re dead. You’d also have a pretty hard time performing at the top of your game if you were faced with the real possibility of you or your family going without the essential things for survival– like the ability to pay pills and stay in your home.

The point of estate and personal financial planning is to minimize the potential for those kinds of life-upending events to happen, although such plans are never truly failsafe and not everyone will have the means to make them. Which is another way of saying that just because we manage to reach our personal peak, there’s no guarantee of staying there, as any number of movie rock star biopics show so well.

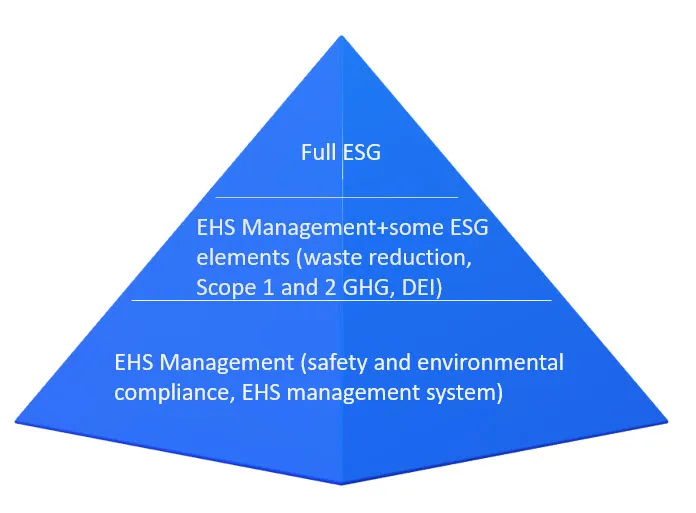

So, how does this relate to ESG management? Put the aspects of ESG into the pyramid, like in the image below.

At the foundational level of your management system, you have many EHS tasks that comprise the “base” of the system. You need to investigate workplace accidents, and initiate and track corrective actions. You need to conduct inspections, including for chemical and hazardous waste storage locations, and you need to make sure you’ve not only assembled a full library of safety data sheets (SDSs), but have also provided access to those documents to all your workers—which is a regulatory requirement under OSHA’s HazCom Standard.

Next comes consideration for the need to comply with an expanding universe of other regulatory obligations, including air emissions and water discharge permitting, and submission of required reports such as EPA’s Chemical Inventory Report (Tier 2) and the Toxic Release Inventory (TRI)/Form R report.

All of these tasks are formidable enough to keep many EHS professionals busy, especially if they lack efficient ways of completing their tasks or sharing responsibility. Many of those professionals, and their organizations, struggle just to keep up with those core tasks. That explains why so few organizations make it farther up the ESG pyramid, let alone to the peak of ESG maturity. And many organizations are somewhere in the middle part, with select ESG elements incorporated into their management system, but with an overall focus still on the basics of EHS management. It’s a continuum, and reaching the peak of true ESG maturity is relatively rare.

But the more important point may be that, much like we’ve seen with Maslow’s pyramid, achieving high-level performance is no guarantee of maintaining high-level performance. If we are unable to stay up to speed with our basic EHS management tasks, the foundation of our pyramid isn’t stable, and the peak of the pyramid – our ESG maturity – collapses.

Takeaways for ESG Management

The overarching takeaway is that ESG doesn’t exist in a separate universe from traditional EHS management. I’ve spoken to a number of people in the industry who haven’t gotten that memo, and seem to think companies who have (or often, who think they have) reached ESG maturity have gone to a kind of heaven, a rarified space far beyond the mundane concerns of traditional EHS management. But, even a company that really has achieved distinguished ESG performance still needs a way of ensuring that the core EHS tasks are getting done. They likely have more efficient ways of doing that, but it’s not at all true that regulatory compliance and basic tasks like inspections and incident investigations don’t matter to them anymore.

A second, closely related takeaway is that if they are not successful at maintaining those core EHS tasks, their ability to maintain ESG maturity disappears. In other words, if the base of the ESG pyramid collapses, the peak comes right down with it.

And a third, closely related takeaway, is that successful ESG management approaches need to be continuous with the methods for managing traditional EHS tasks – to maintain the base of the pyramid. That’s going to be easier to accomplish if our tools for managing our tasks are continuous. This is an important consideration, because some ESG software providers only provide ESG capabilities, which means their customers need to shop elsewhere for capabilities that help with key EHS tasks.

The greater loss may be missing out on the fact that the best EHS management tools help increase engagement by sharing responsibility for key safety tasks, making it easy for employees to perform inspections, report safety incidents and observations, and share insights in safety committee meetings. The EHS tools used should also enable better visibility of safety metrics, which help share progress on EHS management goals and improve buy-in to our programs. These benefits are key building blocks of an ESG approach, which depends on the involvement of all employees from the C-suite to the shop floor, and on efficient processes that make it easy to do the right thing.

Misconceptions about ESG existing in a world apart from traditional EHS management are not just wrong, but actively detrimental to the prospect of establishing and maintaining ESG maturity. However, if you keep the ESG pyramid in mind, you’ll be better prepared to support your ESG initiatives with a strong foundation in the fundamentals.

Let VelocityEHS Help

VelocityEHS understands that successful ESG management doesn’t exist in a universe apart from other EHS management tasks. That’s why we offer ESG capabilities like GHG tracking and energy metrics management alongside a full suite of traditional EHS management tools. Contact us today to request a demo or learn more about how we can help make your business safer and more sustainable.