If you’re like many EHS professionals, you’ve been hearing more ESG the last couple of years, and perhaps your role has even expanded to include managing some ESG initiatives. ESG has quickly become the new standard of excellence for business and EHS management, but you may find it challenging to connect all the dots with your previous responsibilities. ESG Central is designed to help you easily understand how ESG connects to and builds upon traditional EHS management. Check back often for the latest news.

Want to see how software can help with ESG? Check out our ESG solution to learn more or schedule a demo.

ESG Explained

When it comes to ESG, there’s a lot to learn, but this five minute primer will get you started on the road to ESG mastery.

ESG FAQs

The good news about ESG is that you’re not alone. Here are some of the questions many people have as they begin their journey.

ESG Glossary

ESG brings together so many disciplines, it can be confusing keeping all of the terms straight. Our ESG glossary is here to help.

ESG Resources

ESG experts committed to your success developed these resources to take your ESG knowledge to the next level.

ESG Regulations & Standards

Depending on your jurisdiction, ESG is not just a good idea, it is a requirement. Stay up to date on your ESG obligations.

ESG Program Development

Getting started on ESG does not have to be difficult. Here are some simple steps to get your ESG program up and running.

ESG Overview

Here’s a quick two-minute overview of ESG, why it’s on the rise and a few smart ways VelocityEHS can help you navigate the challenges and opportunities.

ESG Explained

What Is ESG?

You’ve probably heard terms like “sustainability” and “corporate responsibility” before. The first pertains to an organization’s efficient use of natural resources and its active reduction of harm to the natural environment and to communities. The second term generally encompasses an organization “doing the right thing” – a concept that includes sustainability but also community involvement, ethical business practice and commitment to the greater good, rather than an exclusive focus on profit.

ESG includes and expands upon these topics, bringing in other stakeholder concerns, many of which have become recognized goals in global frameworks such as the United Nations (UN) sustainable development goals.

Why Is ESG Important?

More and more, business leaders are expected to develop a strategic, systematic approach to ESG and integrate ESG risk management into their financial business model. ESG has quickly evolved from an optional public relations reporting initiative into an increasingly mandatory, investor-driven reporting requirement. A company’s ESG performance is now closely correlated to its share price or its ability to raise capital. Beyond investors, consumers are also making many purchasing decisions based on ESG standards, such as how a company treats its workers and the environment. To put it simply: people, the planet, and profits are now truly linked, and ESG is the way to show you’re running your business responsibly. No matter the size of your business, a sharper focus on ESG provides many advantages you can’t afford to ignore.

What Is Materiality?

The easiest way to think of materiality is as a relevancy filter for the issues that matter most to an organization. Something is considered “material” – or relevant – if it could influence the decision-making of stakeholders regarding the company. Materiality can help an organization choose solid ESG management objectives to structure a program around. It is considered best practice to conduct a materiality assessment as a first step to determine which goals or objectives make the most sense for a business, based on stakeholder priorities.

How Do I Get Started in ESG?

Successful ESG revolves around a strategy, not just starting out blindly. ESG strategy is about being proactive versus responsive, and it should be based on the organization’s internal journey, aligning with the organization’s values. To make the pivot from traditional EHS management to an ESG focus, first take stock of where your company is today on its sustainability journey. Then identify the key stakeholders that will move the program forward. Those stakeholders should be surveyed through a materiality assessment to determine which ESG goals and targets the company should work toward. With that groundwork laid, you can take the right steps toward developing an ESG strategy that works to bring your organization into the future.

The ABCs of ESG

The power of ESG comes from the unification of its three main branches: environmental, social and governance. Here’s a closer look at what’s represented by each component.

Environmental

The E of ESG speaks to a company’s impact on the natural world. It covers a wide-range of activities and sustainability concerns, including:

- Greenhouse Gas Emissions (GHS)

- Air Emissions & Carbon Monitoring

- Energy & Utility Usage Tracking

- Waste Management

- Water Quality

- Environmental Reporting (e.g., TRI/Form R)

Social

The S of ESG focuses on how an organization treats people and operates as a member of communities and supply chains. It includes:

- Health, Safety & Social Sustainability

- Employee Engagement

- Diversity, Equity & Inclusion

- Privacy, Data Protection & Cyber Security

- Product Safety & Stewardship

- Labor Standards & Human Rights

Governance

The G of ESG covers how well a company is managed and how well it abides by ethical practices at all levels, including items such as:

- Business Ethics

- Risk Mitigation & Risk Governance

- Regulatory Compliance

- Tax Transparency

- Shareholder Rights

- Board Composition & Executive Compensation

ESG FAQs

ESG Glossary of Terms

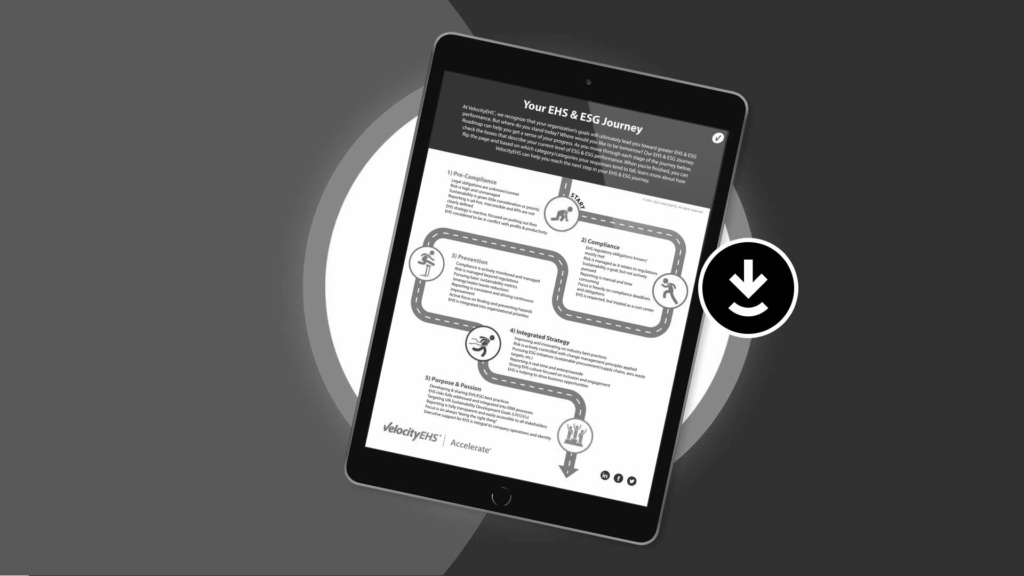

The EHS & ESG Journey

Let VelocityEHS be Your Guide on the Path to EHS & ESG Excellence!

Take our easy self-assessment to gauge your progress, and gain insights on how move forward and keep the momentum going.

ESG Resource Center

Guides & Infographics

Introducing ESG QuickTakes: A Sustainability E-Newsletter

Newsletter

Sustainability

Our NEW quarterly e-newsletter gives you all the industry news, expert guidance, and practical information needed to sharpen your ESG performance. Subscribe now!

EHS to ESG: Starting the Journey

eBook

EHS, Sustainability

Download this eBook to learn why it’s time to incorporate ESG and how to use your current EHS initiatives as a foundation to build ESG maturity.

ESG for the New Sustainability or ESG Manager

eBook

Sustainability

Better understand your role and responsibilities as a sustainability and ESG professional and learn how your success ties into EHS management.

Implementing an ESG Program: The CEO’s Checklist

eBook

Sustainability

Whether you’re new to ESG or looking for new ways to implement ESG initiatives at your workplace, the experts at VelocityEHS® have compiled some great tips in this…

Tracking All Three Scopes of Greenhouse Gas with ESG Software

eBook

Sustainability

Learn the different scopes of Greenhouse Gas (GHG) and how to associate the scopes of GHGs associated with your business.

ESG Materiality Assessments: Practical Guidance & Best Practices

eBook

Sustainability

Wondering how ISO 14001 can help improve ESG and environmental management? This new guide has the information you need.

An Overview of ISO 14001 eBook

eBook

Sustainability

Wondering how ISO 14001 can help improve ESG and environmental management? This guide has the information you need.

What Are “Materiality” and “Double Materiality”? Here’s What You Need to Know

eBook

Sustainability

Download this new guide to learn about materiality assessments and how they can help you identify the ESG risks and opportunities for your organization.

Who are Environmental, Social, and Governance (ESG) Stakeholders?

Infographic

Sustainability

When it comes to ESG, it’s important to know who is invested in your business and the range is broader than just those wanting financial returns.

Guide to Hazardous Waste Management: How to Maintain Environmental Compliance and Build ESG Maturity

eBook

Environmental Compliance

Download this comprehensive 33-page eBook to learn everything you need to know about managing hazardous waste, and how it can even benefit your ESG journey!

Ignite Magazine, Edition 3: EHS & ESG Thought Leadership

Magazine

EHS, Sustainability

The third issue of Ignite magazine includes articles and resources to help you plan for EHS and ESG success in 2023 and beyond. EHS and ESG are the foundation of any …

Ignite Magazine, Edition 4: Accelerating the Maturity Curve

Magazine

EHS, Sustainability

The fourth issue of Ignite Magazine focuses on “Accelerating the Maturity Curve,” offering expert insights and resources to help you mature your organization’s …

Webinars

CEO Checklist for ESG

On Demand Webinar

Sustainability

During this session, you will learn six guiding principles of effective ESG management, get the “CEO Checklist” and receive a simple ESG self-assessment.

Practical Steps to Implement an ESG Program

On Demand Webinar

Sustainability

This webinar will cover tangible steps to begin your ESG journey today, such as how to understand and assess the issues that materially matter most to your organizati…

Intro to Materiality: Why Your ESG Journey Should Start Here

On Demand Webinar

Sustainability

If your organization is ready to start taking ESG seriously, and you’re looking to start building robust and winning ESG programs and strategies, then it’s time t…

Managing ESG: From Materiality to Metrics

On Demand Webinar

Sustainability

This webinar has the information business leaders are looking for as they plan their own ESG journeys.

The Value of ESG to the Financial Community

On Demand Webinar

Sustainability

During this conversational session, participants will gain insights about the importance of ESG from the financial community viewpoint straight from CVC.

Embracing ESG into A Company’s DNA: CF Industries Case Study

On Demand Webinar

Sustainability

Join Kelvin Roth, Vice President, Environmental, Health, Safety & Quality, for an in-depth discussion of CF Industries’ ESG practices and how the organization has i…

The EHS to ESG Journey: Why You Should Care

On Demand Webinar

Sustainability

This on-demand webinar will help you gain the background knowledge and insights you need to guide your own company’s journey from EHS to ESG and shape your continui…

Using Chemical Management and Green Chemistry to Improve Your ESG Maturity and Value Chain Relationships

On Demand Webinar

Safety, Sustainability

Get key takeaways on how to improve chemical management and chemical procurement processes, and how to leverage EHS & ESG software to support your initiatives.

Climate Disclosures and Private Companies: 3 Things to Do Now

On Demand Webinar

Sustainability

To prepare for this new world, private companies, especially those considering an IPO, need to do these three things.

Weathering the Storm: How ESG Maturity Helps You Maintain EHS Compliance in Challenging Times

On Demand Webinar

Sustainability

If you’re one of the many EHS professionals wondering how ESG can benefit you, and how to pursue ESG maturity starting from a current focus on regulatory compliance…

Scope 3 GHGs – Determining Materiality and Quantification Tools

On Demand Webinar

Sustainability

This webinar partnership with Trinity Consultants will provide an overview of the Scope 3 GHG quantification process and key considerations in determining materiality…

Blog Articles:

- Start an ESG Program by Stepping Into it Through Safety

- Start an ESG Program by Stepping Into it Through Ergonomics

- Start an ESG Program by Stepping Into It Through COW

- Start an ESG Program by Stepping Into It Through Operational Risk

- Why Should ESG Matter to Me? Part 2: Sustainability & ESG Mgr.

- Why Should ESG Matter to Me? Part 1: EHS & Safety Managers

- 5 Ways to Get Leadership Buy-In to Sustainability & ESG

- European Financial Reporting Advisory Group (EFRAG) Finalizes First Set of ESG Standards

- What is Green Chemistry & Why is it Important to Safety Management & ESG Maturity?

- EPA’s New Greenhouse Gas Reduction Fund: Here’s What You Need to Know

- Think You Can Wait to Pursue ESG Maturity? Think Again

- Robust Data Management Is Key to ESG Disclosure

- How Well Do You Understand the GHG Protocol Standards?

- What Are “Materiality” & “Double Materiality?”

- ISSB’s Consolidation of ESG Reporting Frameworks

- Understanding the SEC’s Proposed ESG Disclosure Rule

- Have You Mastered the ESG Pyramid?

- Using Ergonomics to Attain the S of ESG

- What is Investment-Grade ESG Data?

- ISSB Publishes First Two Finalized ESG Standards: What You Need to Know

Videos:

External Resources:

Access More ResourcesRegulations & Standards

A key factor in the increased focus on ESG is that it has been driven by investors. Sustainable companies are good investments; however, comparing one company to another can be difficult. That is why stakeholders at every level are demanding transparency and reporting that follow rigorous standards. Following are a few of the most trusted and relied upon standards you should be aware of. Some jurisdictions, like New Zealand, are even making certain reporting compulsory.

SASB | ISSB

SASB Standards, which enable sustainability disclosures, are now part of the International Financial Reporting Standards (IFRS) Foundation and its recently created International Sustainability Standards Board (ISSB).

EFRAG

EFRAG stands for the European Financial Reporting Advisory Group is a private association that works in support of the European Commission, providing draft EU Sustainability Reporting Standards & amendments.

CDP

CDP, once known as the Carbon Disclosure Project, is a non-profit that oversees a system to help companies and others manage their environmental impacts and provides scores on environmental leadership.

TCFD

The Task Force on Climate Related Financial Disclosures (TCFD) was created by the Financial Stability Board (FSB) to support capital allocation decisions by pricing risk through climate disclosure recommendations.

SEC

Recently the US Securities and Exchange Commission (SEC) proposed amendments to rules and reporting forms to establish disclosure requirements for those fund and advisors that claim an ESG focus.

SASB | ISSB

SASB Standards, which enable sustainability disclosures, are now part of the International Financial Reporting Standards (IFRS) Foundation and its recently created International Sustainability Standards Board (ISSB).

EFRAG

EFRAG stands for the European Financial Reporting Advisory Group is a private association that works in support of the European Commission, providing draft EU Sustainability Reporting Standards & amendments.

CDP

CDP, once known as the Carbon Disclosure Project, is a non-profit that oversees a system to help companies and others manage their environmental impacts and provides scores on environmental leadership.

TCFD

The Task Force on Climate Related Financial Disclosures (TCFD) was created by the Financial Stability Board (FSB) to support capital allocation decisions by pricing risk through climate disclosure recommendations.

SEC

Recently the US Securities and Exchange Commission (SEC) proposed amendments to rules and reporting forms to establish disclosure requirements for those fund and advisors that claim an ESG focus.

ESG Program Development

Step 1: Materiality Assessment

Prioritize Your Objectives

When you’re embarking on a journey, knowing where you want to go and why is a critical first step. This is especially true of your ESG journey. A materiality assessment helps you build the map, and ensure that you have the right people along for the ride.

The VelocityEHS ESG Solution is the best way to align your strategy and goals while ensuring transparency across your organization and supply chain. Rate, rank and prioritize your issues using a survey with built-in SASB standards, and automatically turn your results into a custom materiality matrix.

Step 2: Select Your Metrics

Know What Measurements Matter

Because ESG encompasses so many areas, it can be difficult to know what to start measuring first, especially when you are just starting out. The temptation is to try and do too much too soon, which can lead to frustration and burn out.

However, using your materiality assessment, you should be able to identify a mix of short term targets and long term goals that will make a substantive impact on your organization. Selecting metrics aligned to these goals can help you build momentum as you get your ESG program off the ground.

Learn best practices from our industry-leading experts

Check out the latest industry news, our most recent blogs, and helpful training resources that will ensure you stay ahead of the curve.

Navigating AI in EHS: Introducing the VelocityEHS AI Glossary & Learning Hub

VelocityAI

Our AI Glossary & Learning Hub is a curated, easy to understand, and trusted space for EHS professionals to learn, explore, and level up your AI expertise.

The Crucial Role of Contractor Compliance in Winning More Business

Contractor Safety & Permit to Work

Here’s why contractor compliance is critical for winning more business and positioning yourself as a key player within your industry.

Ready to see VelocityEHS in action?

Request a demo today to see how we help organizations like yours gain control of their EHS & ESG strategy and empower global teams for success.

Request A DemoPartner with the most trusted name in the industry

Stress less and achieve more with VelocityEHS at your side. Our products and services are among the most recognized by industry associations and professionals for overall excellence and ease of use.